Fill Your I 312 Template

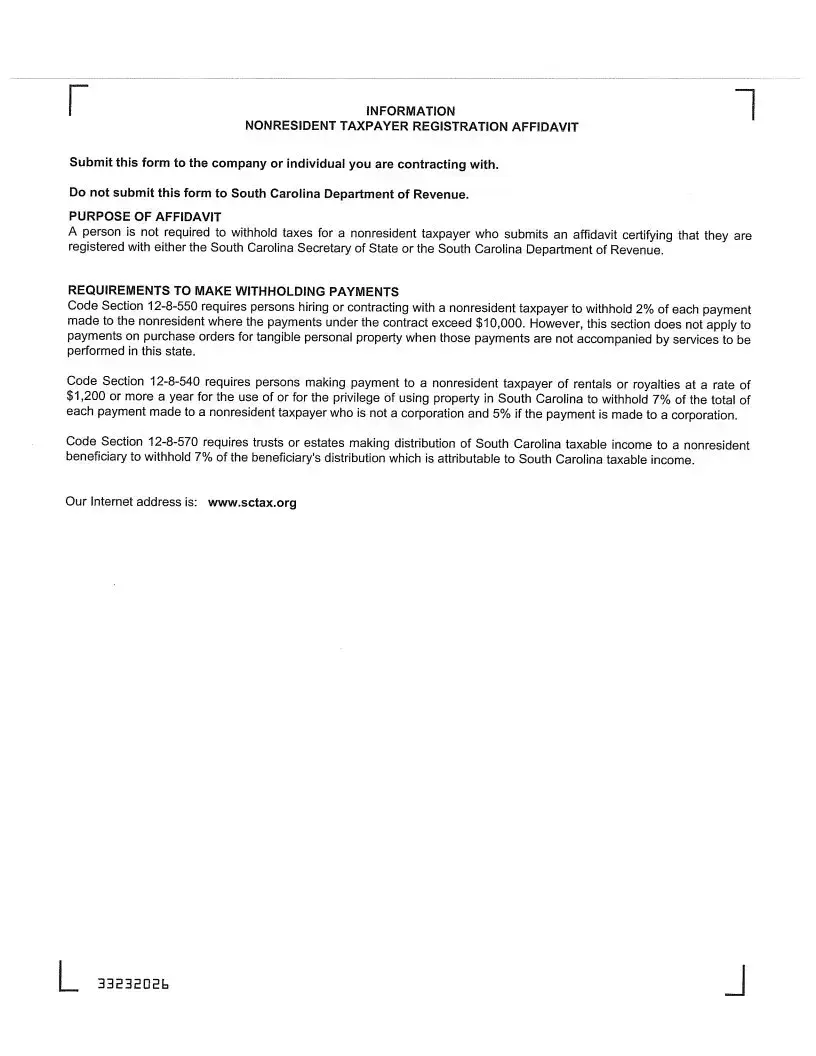

For individuals navigating the complexities of tax obligations in various states, understanding the specific requirements and forms unique to a state is indispensable. South Carolina's approach to withholding taxes from nonresidents conducting business or rendering services within its borders is encapsulated in its legislation, which mandates a withholding tax, and is facilitated by the I-312 form, officially known as the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding. This form serves a critical role in the financial and operational framework for nonresidents and employers alike, elucidating the withholding requirements for payments made to nonresidents engaging in temporary business or personal services. Notably, the form clarifies exceptions to these requirements, such as for those not conducting business in the state or in cases where contracts don't exceed a specific threshold. Furthermore, it offers a pathway for compliance through registration with the state’s Department of Revenue or Secretary of State and submission of the form. The I-312's significance extends to its utility across various scenarios, including government entities engaging contractors and the payment of rentals or royalties exceeding a certain amount. The document's implications for nonresident individuals and entities underscore the nuanced landscape of state tax obligations, highlighting the importance of being well-informed and proactive in regulatory compliance.

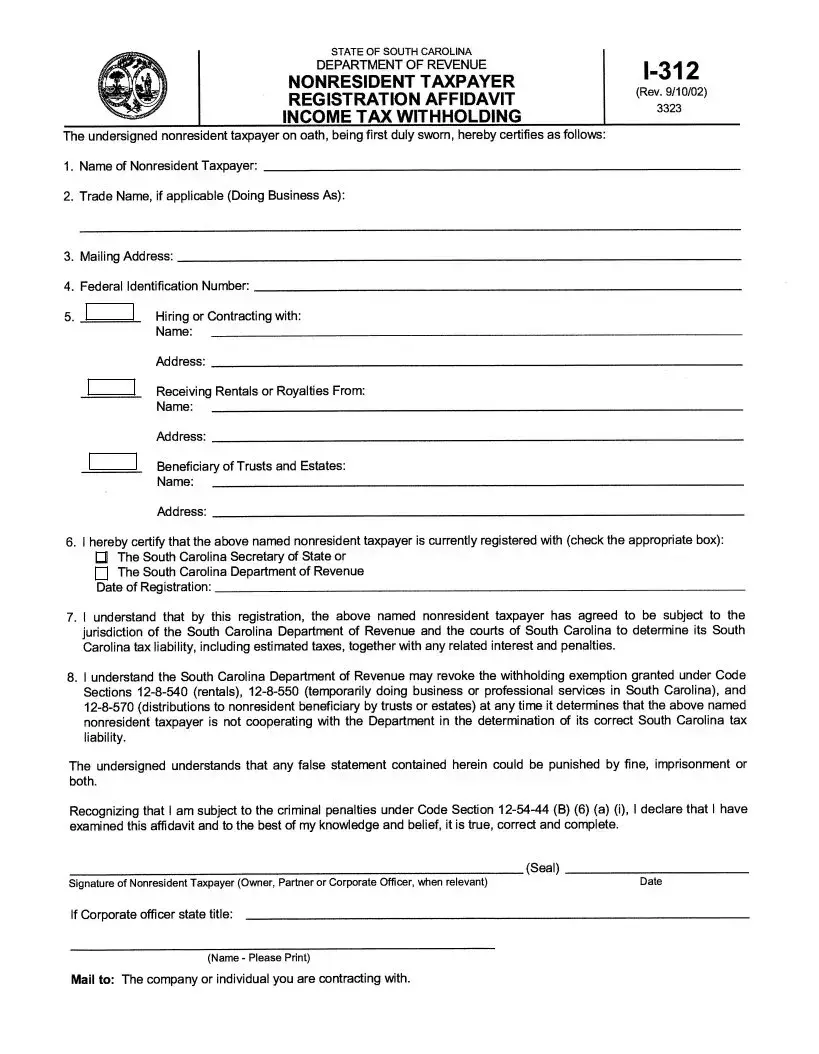

Document Example

IMPORTANT TAX NOTICE - NONRESIDENTS ONLY

Withholding Requirements for Payments to Nonresidents: Section

The withholding requirement applies to every governmental entity that uses a contract ("Using Entity"). Nonresidents should submit a separate copy of the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form

Section

For information about other withholding requirements (e.g., employee withholding), contact the Withholding Section at the South Carolina Department of Revenue at

www.sctax.org.

This notice is for informational purposes only. This agency does not administer and has no authority over tax issues. All registration questions should be directed to the License and Registration Section at

(Please note that vendor registration does not substitute for any obligation to register with the S.C. Secretary of State or S.C. Department of Revenue. You can register with the agencies at http://www.scbos.com/default.htm.)

Form Properties

| Fact | Detail |

|---|---|

| 1. Purpose | This form is a Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, used in South Carolina. |

| 2. Target Users | Meant for nonresidents conducting business or providing services temporarily within South Carolina. |

| 3. Withholding Rate for Services | A 2% withholding rate is applied to payments made to nonresidents for services performed in South Carolina. |

| 4. Exceptions to Withholding Requirement | Exceptions include payments for tangible goods without services, non-business-conducting nonresidents, contracts under $10,000, and registered nonresidents providing Form I-312. |

| 5. Governmental Entity Requirement | All governmental entities using contracts within the state must comply with the withholding requirements. |

| 6. Validity of Affidavit | Once submitted to a Using Entity, the affidavit is valid for all contracts unless the exemption is revoked by the Revenue Department. |

| 7. Withholding Rates for Rentals and Royalties | A 7% rate for non-corporate and 5% for corporate nonresidents on rentals or royalties over $1,200 annually. |

| 8. Department of Revenue Contact | For withholding queries, contact the Withholding Section at 803-898-5383 or visit www.sctax.org. |

| 9. Governing Law | Section 12-8-550 and Section 12-8-540 of the South Carolina Code of Laws govern these requirements. |

Guide to Writing I 312

Filling out the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312, is a key step for nonresident individuals and entities engaging in business or rendering services in South Carolina. This process facilitates compliance with the state's tax withholding requirements, ensuring that nonresidents meet their obligations under South Carolina law. The instructions below aim to simplify the procedure, guiding you through each part of the form and ensuring accuracy in its completion.

- Download the form: Access the I-312 form by visiting the South Carolina Department of Revenue website at www.sctax.org. Ensure you have the latest version of the form.

- Read the instructions carefully: Before you start filling out the form, take a moment to read through the entire document. Understanding the requirements and information needed will help you avoid mistakes and ensure that the form is completed accurately.

- Complete the basic information: Fill in the essential details about the nonresident individual or entity. This includes the name, address, and the nature of the business or services provided in South Carolina.

- Identify the type of payment: Specify the type of payments to be received, whether it's for personal services, rentals, royalties, or other business activities. Be clear and precise to avoid any confusion regarding the nature of the payments.

- Determine the withholding rate: Based on the information provided in the Important Tax Notice, calculate the correct withholding rate for your situation. This could be 2% for personal services or the applicable rate for rentals and royalties mentioned in Section 12-8-540.

- Include any applicable exemptions: If your contract doesn’t exceed $10,000 in a calendar year or if you have registered with the South Carolina Department of Revenue or Secretary of State, indicate these exemptions on the form to avoid unnecessary withholding.

- Contact information: Provide current contact information for both the nonresident taxpayer and the entity making the payment. This ensures that any questions or issues regarding the form or withholding can be resolved promptly.

- Signature and date: The form must be signed and dated by the nonresident taxpayer or an authorized representative. This attests to the accuracy of the information provided and acknowledges the obligations under South Carolina tax law.

- Submit the form: A separate copy of the completed I-312 form should be submitted to every governmental entity or business that is making a payment to the nonresident under the outlined circumstances. Ensure you keep a copy for your records.

After submitting Form I-312, the appropriate South Carolina entities will have the information needed to comply with state withholding requirements for payments made to nonresidents. It streamlines the taxation process, potentially avoiding delays or issues with payment. Always double-check the form for accuracy and completeness before submission to ensure a smooth process. Remember, tax laws and forms can change, so it's a good idea to verify that you have the most current information and forms before submitting.

Understanding I 312

What is the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312?

The Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312, is a document that nonresidents performing services or conducting business in South Carolina must submit to exempt themselves from a 2% withholding requirement on payments for services rendered within the state. This form is required for any nonresident contractor or business entity engaging in temporary activities in South Carolina and serves as a declaration for tax withholding purposes.

Who needs to withhold taxes according to the South Carolina Code of Laws Section 12-8-550?

According to Section 12-8-550 of the South Carolina Code of Laws, any person or entity hiring or contracting with a nonresident conducting business or performing services of a temporary nature within South Carolina is responsible for withholding 2% of each payment made to the nonresident. This requirement applies to every governmental entity entering into a contract with a nonresident for these purposes as well.

Are there any exceptions to the withholding requirement?

Yes, there are several exceptions to the 2% withholding requirement. It does not apply to payments made for purchase orders of tangible personal property without accompanying services in South Carolina, nonresidents not conducting business within the state, contracts that do not exceed $10,000 in a calendar year, or payments made to nonresidents who register with the South Carolina Department of Revenue or Secretary of State and submit Form I-312.

How does a nonresident submit Form I-312?

Nonresidents must submit a separate copy of the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312, to every entity that makes payments to the nonresident as part of the contractual agreement. Once submitted, the form is valid for all contracts between the nonresident and the entity unless the Department of Revenue notifies the entity that the exemption has been revoked.

Where can I find more information about other withholding requirements or contact the Department of Revenue?

For more details on additional withholding requirements, such as those for employee withholding, you can contact the Withholding Section at the South Carolina Department of Revenue by calling 803-898-5383. Further information can also be found on their official website at www.sctax.org. Questions about registration should be directed to the License and Registration Section at 803-898-5872 or to the South Carolina Department of Revenue's Registration Unit.

Common mistakes

Filling out the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312, is a crucial step for nonresidents doing business in South Carolina. However, some common mistakes can lead to delays or even penalties. Here’s a list of the top 10 errors to avoid:

- Not verifying if you qualify as a nonresident who must submit Form I-312. Only nonresidents engaging in business or performing services in South Carolina need to fill out this form.

- Misunderstanding the types of payments subject to withholding. It's essential to know that withholding applies not just to personal services but may also include rentals or royalties above certain thresholds.

- Failing to provide a separate affidavit for each Using Entity. One form per entity ensures that each one is aware of your compliance with the state’s regulations.

- Overlooking the exemptions. Certain conditions, such as contracts not exceeding $10,000 in a year or registration with the South Carolina Department of Revenue, can exempt you from withholding requirements.

- Incorrectly filling out your personal or business information. Accuracy is key to ensuring your affidavit is processed without delays.

Beyond these specifics, there are more general areas where errors can occur:

- Forgetting to sign and date the affidavit. An unsigned or undated form is typically considered incomplete.

- Not checking the form for any recent updates or changes in requirements. Always use the latest version available from the South Carolina Department of Revenue's website.

- Omitting supporting documents. Sometimes, additional documentation may be required to substantiate your claims on the form.

- Assuming registration with the South Carolina Secretary of State or Department of Revenue is a one-time event. Keep in mind that certain changes in your business status or operations may require re-registration or updates to your info.

- Failing to contact the appropriate department if you have questions. The South Carolina Department of Revenue is available to assist with questions regarding the affidavit or withholding requirements.

By steering clear of these common pitfalls, you can ensure a smoother process when dealing with your withholding obligations in South Carolina. Always remember to consult the latest documents and reach out to the appropriate departments if you're unsure about any requirements.

Documents used along the form

When managing financial affairs or regulatory compliance in the context of working with nonresidents in South Carolina, a variety of documents and forms may be necessary alongside the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312. The Form I-312 plays a significant role in adhering to the state's requirements on withholding tax for nonresidents but it's often one piece of a broader documentation puzzle. Here are some additional forms and documents that often accompany or are related to the Form I-312:

- W-8BEN Form: Used by nonresident aliens to claim tax treaty benefits and certify their foreign status.

- W-9 Form: Request for Taxpayer Identification Number and Certification, used for another party to accurately report taxable income to the IRS.

- Form 1042-S: Foreign Person's U.S. Source Income Subject to Withholding. This form reports amounts paid to foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts.

- SC1040: South Carolina Individual Income Tax Return. Though primarily for residents, nonresidents with income sourced from South Carolina must also file this return.

- SC1120: South Carolina Corporation Income Tax Return, required for foreign corporations doing business in South Carolina.

- UCC-1 Financing Statement: Common in contractual agreements, this form is filed to give notice that a lender has an interest in the personal property of a borrower (used in various states including South Carolina).

- SC2848: Power of Attorney and Declaration of Representative. This document is used to authorize an individual, such as an accountant or attorney, to represent the taxpayer before the SC Department of Revenue.

- Business License Application: Required for any nonresident conducting business in South Carolina, ensuring compliance with local laws and regulations.

Together, these documents ensure that nonresidents are in full compliance with South Carolina's laws regarding income earned within the state. Each form serves its unique purpose, from establishing tax status to reporting and paying the correct amount of taxes. Ensuring that all relevant documents are correctly filled out and submitted in conjunction with Form I-312 can help nonresidents avoid legal complications and ensure smooth financial operations in South Carolina.

Similar forms

The Form 1099-MISC is one document that shares similarities with the I-312 form, particularly in the context of reporting payments to nonresidents for tax purposes. Both forms serve the purpose of ensuring compliance with tax withholding requirements on payments made to individuals or entities not based in the jurisdiction of the payment origin. The Form 1099-MISC, however, is more broadly applicable, covering various types of payments beyond temporary services or rentals, and it includes payments to residents as well as nonresidents.

The Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, is another document that has parallels with the I-312 form. It is used by nonresident aliens to report their status and claim tax treaty benefits, if applicable. Like the I-312, the Form W-8BEN helps determine the correct tax withholding rate. Nonetheless, the Form W-8BEN is utilized in a wider range of contexts, including passive income like dividends and interest, not limited to personal services or business activities within the United States.

The Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, also resembles the I-312 form in its function. It specifically allows nonresident aliens performing independent personal services in the United States to claim an exemption from withholding on the basis of a tax treaty. Like the I-312, the Form 8233 is an affidavit where the nonresident asserts their claim for lesser or no withholding based on treaty benefits, narrowly focusing on personal service compensation.

The Form W-9, Request for Taxpayer Identification Number and Certification, contrasts with the I-312 form by being used primarily within the domestic (U.S.) context but is similar in its role of ensuring the correct tax withholding and reporting. Individuals and entities provide their Taxpayer Identification Number (TIN) on the W-9 to the entities that pay them, enabling these entities to accurately report payments to the IRS. The I-312, conversely, is more focused on nonresident activities within a specific state (South Carolina) and their tax obligations there.

The Certificate of Compliance for Withholding Tax is a document necessary in several states that, like the I-312 form, certifies a nonresident has complied with state tax withholding requirements on income earned within the state. Although specifics vary, this certificate generally serves the same purpose as the I-312 in establishing a record of tax obligations being met by nonresidents engaged in business or personal services.

The IRS Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is used to report amounts paid to foreign persons, including nonresidents, that are subject to income tax withholding. The I-312 shares the objective of withholding tax from nonresidents to ensure compliance with state tax laws, whereas the 1042-S is focused on federal tax obligations for a wide range of income types, including scholarships, royalties, and wages.

The New York State Form IT-2663, Nonresident Real Property Estimated Income Tax Payment Form, is specific to New York State and applies to nonresidents selling real property located within the state. It requires the seller to calculate and pay an estimated tax on the income derived from the sale. Although it is specific to real estate transactions, it shares the I-312’s goal of collecting tax from nonresidents on income earned within the jurisdiction.

The California Form 592, Resident and Nonresident Withholding Statement, is parallel to the I-312 form in that it deals with withholding taxes from payments made to nonresidents for income sourced within the state. This form is broader in scope, encompassing dividends, rents, royalties, and other types of income, emphasizing the importance of state-level compliance for a variety of income sources, similar to the I-312’s focus within South Carolina.

The Pennsylvania Form REV-1832, Nonresident Withholding Tax Declaration, functions similarly to the I-312 by mandating withholding tax for payments made to nonresident contractors for services performed within the state. This form is part of Pennsylvania’s broader approach to taxation of nonresident income, aligning with the I-312’s objective of ensuring nonresidents pay appropriate taxes on income derived from state sources.

Lastly, the Michigan Form 5014, Reporting of Magi Media Production Expenses, although primarily focused on the film industry, illustrates a specialized version of income reporting and withholding similar to what the I-312 form mandates. It requires withholding and reporting on payments to nonresidents involved in media production within the state, reflecting the I-312 form’s broader principle of tax compliance for nonresident income activities.

Dos and Don'ts

When filling out the Nonresident Taxpayer Registration Affiditation - Income Tax Withholding, Form I-312, it's essential to follow guidelines designed to ensure compliance with South Carolina's tax requirements for nonresidents. Below is a list of do's and don'ts to assist in the process:

Do's:- Review the withholding requirements carefully: Understand the specific situations under which withholding is required, such as conducting business or performing temporary services in South Carolina.

- Register with the S.C. Department of Revenue or the S.C. Secretary of State if applicable: Registration is a prerequisite for submitting Form I-312 for individuals who wish to claim exemption from withholding.

- Submit Form I-312 to each Using Entity: A separate copy of the affidavit must be provided to every government entity that makes payments to the nonresident under the contract.

- Check eligibility for exemptions: Confirm whether the contract falls under any of the exceptions to the withholding requirement, such as contracts not exceeding $10,000 in a calendar year.

- Keep informed about applicable withholding rates: Be aware of the different withholding rates for payments related to rentals, royalties, and services.

- Refer to the correct section of the South Carolina Code of Laws: Section 12-8-550 outlines the withholding requirements for nonresidents, ensuring understanding and compliance.

- Contact the relevant authorities for questions: Reach out to the South Carolina Department of Revenue or the specified contacts for any queries regarding the form or withholding requirements.

- Ignore the requirement to submit to each Using Entity: Failing to provide a copy of Form I-312 to every entity making payments can result in non-compliance.

- Assume registration with other agencies substitutes for Form I-312: Even if already registered with the South Carolina Department of Revenue, submitting Form I-312 is still necessary.

- Overlook the need for renewal: Always check if there have been any notices from the Department of Revenue revoking the exemption, requiring a new affidavit submission.

- Misunderstand the exemptions: Pay close attention to the conditions under which the withholding requirement does not apply to ensure accurate filings.

- Miscalculate the contract value: Incorrectly assessing if a contract exceeds the $10,000 threshold can lead to non-compliance with the withholding requirements.

- Fail to keep updated records: Ensure that all copies of Form I-312 and related correspondence are stored securely for reference and potential audit purposes.

- Disregard changes in tax law: Stay informed about any modifications to the tax laws or withholding rates that may affect obligations under South Carolina law.

Misconceptions

Many misconceptions exist about the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312, and its requirements. Understanding the facts can help navigate through the processes involved more smoothly.

Misconception #1: The Form I-312 is only for individuals.

Fact: Though it's commonly thought that Form I-312 is strictly for individual nonresidents, it also applies to entities. Any nonresident - whether an individual or a business entity - conducting business or performing personal services in South Carolina needs to comply with the form's requirements.

Misconception #2: Submission of Form I-312 exempts nonresidents from all South Carolina taxes.

Fact: Submitting Form I-312 only provides an exemption from the specific withholding requirement on payments made for services rendered in South Carolina. Nonresidents might still be liable for other state taxes, including income taxes, depending on their earnings within the state.

Misconception #3: The 2% withholding rule applies to the purchase of tangible personal property.

Fact: The requirement to withhold 2% does not apply to payments made for the purchase of tangible personal property when not accompanied by services within South Carolina. The key factor is whether services are performed alongside the purchase.

Misconception #4: Any payment to a nonresident necessitates withholding.

Fact: There are exceptions to the rule. For instance, payments for contracts not exceeding $10,000 in a calendar year or payments to registered nonresident taxpayers who have submitted Form I-312 are exempt from withholding.

Misconception #5: Only the original copy of Form I-312 is acceptable.

Fact: Nonresidents should submit a separate copy of the Form I-312 to every contracting entity making payment to them. This implies that duplicates of the originally submitted form are indeed acceptable and required for compliance.

Misconception #6: Form I-312 is a one-time submission.

Fact: Once submitted, the affidavit is valid for all contracts between the nonresident and the entity, unless notified otherwise by the Department of Revenue. However, if details of the nonresident taxpayer or the contracting entity change, a new Form I-312 may need to be submitted to reflect accurate current information.

Misconception #7: Vendor registration with the S.C. Secretary of State or Department of Revenue substitutes the need for Form I-312.

Fact: Although vendor registration is important, it does not replace the requirement to submit Form I-312 for nonresident contractors. Both types of registration serve different purposes and are required for compliance with state regulations.

Understanding the specifics of the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312 is crucial for nonresidents conducting business or performing services in South Carolina. By debunking these misconceptions, nonresidents can ensure proper compliance with state law, avoid potential penalties, and operate more smoothly within the state.

Key takeaways

- Understand the withholding requirements: For nonresidents conducting business or providing personal services temporarily in South Carolina, it's essential to grasp that a 2% withholding on each payment made to them may apply. This requirement is specifically targeted toward nonresident contractors and business entities under Section 12-8-550 of the South Carolina Code of Laws.

- Exceptions to the rule: Not everyone is subject to this withholding. The rule does not apply to nonresidents who do not carry out business in South Carolina, transactions purely for tangible personal property without accompanying services in South Carolina, contracts not exceeding $10,000 in a calendar year, and nonresidents who have properly registered and submitted the Nonresident Taxpayer Registration Affidavit - Income Tax Withholding, Form I-312.

- Submitting the Form I-312: To avoid withholding on payment, nonresidents must register with the South Carolina Department of Revenue or the Secretary of State and submit Form I-312 to each entity that contracts them for work in South Carolina. One submitted form will cover all contracts with that entity until any exemption is revoked, simplifying the process for multi-contract scenarios.

- Seek additional information and assistance: For more detailed guidance or any inquiries about withholding requirements and other tax obligations, nonresidents are encouraged to contact the South Carolina Department of Revenue directly. The Department provides resources and contact information for both the license registration and withholding queries, serving as a primary point of assistance for tax-related concerns.

More PDF Templates

Sc State Tax Form - The South Carolina 1040ES form is for individuals to declare estimated tax for the year 2003.

Simon Vaccine - Aims to streamline the documentation and correction of vaccine borrowing, ensuring program integrity and effectiveness.

Sc4868 - Before submitting, double-check that all required information, including your address and social security number, is accurate.