Fill Your Pt 442 Template

In the realm of motor carrier operations within South Carolina, the Application for Motor Carrier Property Tax, known formally as PT-442, serves as a critical document that facilitates the proper assessment and collection of property taxes by the Department of Revenue. Designed for business entities that own or lease motor vehicles with a gross vehicle weight exceeding 26,000 pounds, as well as buses equipped with a BC tag for hire carrying 16 or more passengers, this form encompasses a broad spectrum of information including the ownership details, physical and mailing addresses, type of ownership, and specific vehicle details among other requirements. Detailed in its scope, the PT-442 form mandates the disclosure of the Federal Identification Number (FEI) or Social Security Number (SSN) to ensure accurate identification and processing. Furthermore, it outlines the conditions regarding special mobile and farm tags, emphasizes the significance of submitting accurate information to consolidate vehicle files, and advises on procedures for reporting changes in vehicle ownership or status, thereby playing a pivotal role in the tax administration process. Additionally, it outlines the due dates for tax submissions, explains the implications of late filings, and establishes the guidelines for retaining records, underscoring the form's comprehensive nature in governing motor carrier property taxes in the state.

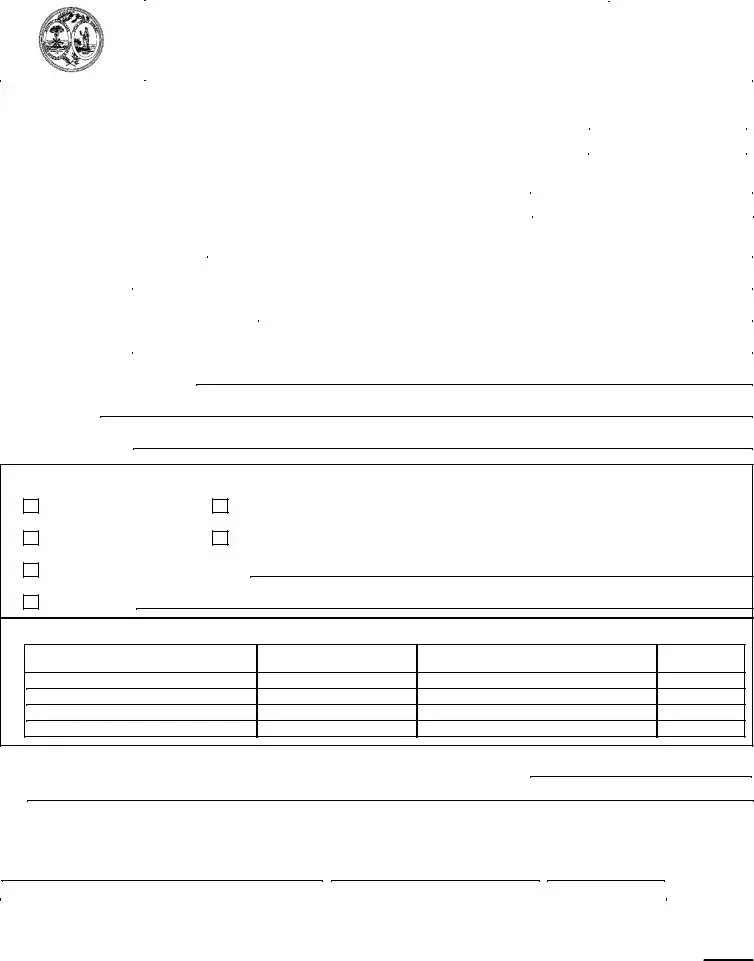

Document Example

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

|

|

|

|

|||

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|||

|

|

|

|

|

APPLICATION FOR MOTOR |

|

|

|

(Rev. 4/4/02) |

||||||

|

|

|

|

|

|

CARRIER PROPERTY TAX |

|

|

|

7070 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone: |

(803) |

|

|

|

|

|

|

|

For Office Use |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Mail to: South Carolina Department of Revenue |

|

|

|

SID No. |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||||

|

License and Registration |

|

|

|

File No. |

|

|

|

|

|

|||||

|

Columbia, South Carolina |

|

|

|

|

|

|

|

|

|

|||||

|

|

FEI |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

||

1. |

Name of Owner/Corporation |

|

|

|

|

|

|

|

|

|

|

||||

2. |

Business Name |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Please Print or Type |

|

|

|

|

|

|

|

|

3. Physical Location (no post office box) |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Street No. - RFD |

City |

County |

|

State |

Zip Code |

||||

4. |

Mailing Address |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Street No. - RFD, Post Office Box |

City |

County |

State |

Zip Code |

|||||||

5.Open Date at this Location

6.Telephone

7.No. of Locations

8.Type Of Ownership

Sole Proprietor

LLC/LLP

Partnership

Unincorporated Association; Enter Legal Name

Corporation; Enter Charter Name

Other; Explain

9. Names of Business Owner, Partners or Officers:

Name/Title |

Social Security No. |

Address |

If Partner, |

|

Percent Owned |

||||

|

|

|

1.

2.

3.

4.

10. We have physical locations (real property owned or leased) in the following counties:

I declare that the application, including the accompanying schedules, if any, has been examined by me and to the best of my knowledge and belief the information contained therein is true and correct.

SIGNATURE OWNER, PARTNERS OR CORPORATE OFFICER |

TITLE |

DATE |

|

|

|

The statutes covering the Motor Carrier Property Tax are Code Sections

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

State of South Carolina

Department of Revenue

301 Gervais Street, P.O. Box 125, Columbia, South Carolina, 29214

SOUTH CAROLINA MOTOR CARRIER PROPERTY TAX

INFORMATION SHEET

Calendar Year, Due Date, Vehicles to Be Included

The motor carrier property tax return for the calendar year 2003 is due by June 30, 2004. The return should include all vehicles registered with a gross vehicle weight greater than 26,000 pounds and buses for hire registered with a BC tag designed to carry 16 or more passengers including the driver.

Please use Blue or Black Ink only when completing the for

Special Mobile Tags

If the vehicles have SM tags, the property taxes should be paid to the County not the Department of Revenue.

Farm Tags

Starting with calendar year 2000, there is no weight class for farm tags with the Department of Revenue. If the vehicle(s) have FM tags, the property taxes should be paid to the County.

Federal Identification Number (FEI)/Social Security Number (SS)

A return cannot be processed without a FEI or SS number. The number provided should be for the owner of the vehicle. All type corporations and partnerships should provide the FEI number. Individuals/sole proprietors should provide their

SSnumber and FEI if one has been assigned to them. This number is also required because it will allow the Department of Revenue to continue to pursue a method to consolidate the vehicle file.

Filing One Return For All Vehicles

The Department of Revenue is still working to consolidate the file received from the Department of Public Safety so that vehicle owners may file one return for all vehicles required to be reported. Because of the different names used to register vehicles and the lack of valid FEI/SS numbers, more than one return may have been received. DO NOT throw any tax returns away.

If more than one return is received, please use the one with the file number you filed under for tax year 2002. All vehicles MUST be reported on one return. If this is the first time you filed and you received more than one return, please use the return with the most correct information and indicate on the others the file number you filed under. (Example: All information reported on DOR

Vehicle Sold

If the vehicle(s) have been sold prior to December 31, 2003 please attach a copy of the Bill of Sale to the

Vehicle Repossessed

If the vehicle was repossessed prior to December 31, 2003, you will need to attach written confirmation from the financial institution as to the day the vehicle was picked up and they regained possession of the vehicle. If the vehicle was repossessed after December 31, 2003 the return and payment for 2003 are still due.

(Rev. 2/18/04)

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

Credit Balance (Line 8)

If there is a credit balance from the return for calendar year 2002, use Line 8 to take credit against the current tax liability. Keep a record of any credit balance remaining to be used on next year's return. All credit deductions are subject to the future verification and audit of the original credit deducted for calendar year 1997. If you did not file a return for 1997 you would have no credit balance.

This office will be unable to verify credit information by telephone due to the number of calls expected concerning filing the current return and the time required to do the verification.

Property Taxes Charged By County

If the county charged property taxes for vehicles required to be reported on this return, you should contact the county auditor's office to request a refund from the county. No credit is allowed on the Motor Carrier Property Tax return for taxes paid to the county.

Payment of Property Tax

If a return is filed by June 30, 2004 the law allows for a split payment of the tax. No less than

Application for Motor Carrier Property Tax form

New accounts are asked to complete the enclosed

Record Keeping

Keep a copy of all returns filed with the Department of Revenue and keep records to substantiate information included on the return. Records should be kept for at least three years.

Schedule

Complete Purchase date and Purchase price for all listed vehicles. Any vehicles you may own with a GVW greater than 26,000 pounds that are not listed,should be added to the schedule and all columns completed.

Telephone Numbers

For assistance call (803)

Mailing Address

SC Department of Revenue

MC Property Tax

Columbia SC

Form Properties

| Fact | Detail |

|---|---|

| Form Name and Revision Date | PT-442, Revised on April 4, 2002 |

| Purpose | Application for Motor Carrier Property Tax in South Carolina |

| Contact Information | Telephone: (803) 898-5222, Mail to: South Carolina Department of Revenue, Columbia, South Carolina 29214-0140 |

| Governing Law(s) | Code Sections 12-37-2810 through 2880, 42 U.S.C 405(c)(2)(C)(i), SC Regulation 117-1, SC Regulation 117-201 |

| Due Date for Tax Year 2003 | June 30, 2004 |

| Vehicle Requirements | Applies to vehicles with a gross vehicle weight greater than 26,000 pounds and buses for hire with a BC tag designed to carry 16 or more passengers including the driver |

| Important Provisions |

|

| Payment and Record Keeping |

|

Guide to Writing Pt 442

Filing the PT-442 form is a necessary step for motor carriers in South Carolina to comply with state tax obligations. This process involves providing detailed information regarding the ownership and operational specifics of your motor carrier business. It’s important to proceed carefully to ensure all provided data is accurate and complete, as this information will be used by the South Carolina Department of Revenue to assess your property tax responsibilities. To aid in this process, follow the outlined steps below:

- Locate and prepare to fill out the "STATE OF SOUTH CAROLINA PT-442 DEPARTMENT OF REVENUE APPLICATION FOR MOTOR CARRIER PROPERTY TAX" form.

- Enter the "Name of Owner/Corporation" in the space provided.

- Fill in the "Business Name" as it appears in official documents.

- For "Physical Location", input the street number, city, county, state, and zip code. Note: This cannot be a post office box.

- Provide the "Mailing Address", which may include a P.O. Box if necessary, along with the city, county, state, and zip code.

- Specify the "Open Date at this Location" by entering the date your business commenced operations at the given address.

- Include a contact "Telephone" number for the business.

- Indicate the "No. of Locations" that your business operates from.

- Select the "Type Of Ownership" from the options provided and include any necessary details, such as the legal name of an unincorporated association or the charter name of a corporation.

- List the "Names of Business Owner, Partners, or Officers", including their title, social security number, address, and, if applicable, the percent owned for partners.

- Identify all counties where your business owns or leases physical locations.

- Finally, review the application thoroughly. The owner, partners, or a corporate officer must sign and date the form, certifying the accuracy of the information provided.

After completing the form, it’s crucial to attach any required documentation, such as a Bill of Sale for sold vehicles or written confirmation of vehicle repossession, if applicable. Ensure that you use blue or black ink throughout the process, as requested. Once everything is in order, mail the form to the provided address of the South Carolina Department of Revenue. Keeping a copy of the filled-out form and any accompanying documents for your records is advisable. This meticulous approach will assist in maintaining compliance with state regulations and facilitate any future inquiries or audits.

Understanding Pt 442

What is the PT-442 form used for?

The PT-442 form is an application for motor carrier property tax in the State of South Carolina. It is used by owners of vehicles with a gross vehicle weight greater than 26,000 pounds, buses for hire with a BC tag, and other specified categories of motor carriers to declare property tax. This declaration is based on the ownership of these vehicles as of December 31 of the preceding year.

Who is required to file the PT-442 form?

Individuals, companies, or corporations owning or leasing vehicles registered with a gross vehicle weight greater than 26,000 pounds, buses designated for hire carrying 16 or more passengers including the driver, and owners of vehicles with Special Mobile (SM) or Farm (FM) tags (under specific conditions) are required to file the PT-442 form. Inter-City buses are excluded.

What is the deadline for filing the PT-442 form?

The deadline for filing the motor carrier property tax return using form PT-442 is June 30th of the year following the tax year. For instance, for the tax year 2003, the deadline would be June 30, 2004.

Are there any specific types of vehicles that are excluded from the PT-442 filing?

Yes, vehicles that have been purchased in the year following the tax year in question should not be included in the PT-442 form. Also, Inter-City buses are expressly excluded from this requirement according to the information provided.

What happens if I sold or repossessed a vehicle before December 31?

If a vehicle was sold or repossessed before December 31, the seller should attach a copy of the Bill of Sale or written confirmation from the financial institution indicating the repossession date to the PT-442 form. The tax responsibility for that vehicle for the year in question is then removed from the seller.

Is it mandatory to provide a Social Security or Federal Identification Number on the PT-442 form?

Yes, it is mandatory to provide a Social Security Number (SSN) or Federal Identification Number (FEI) on the PT-442 form. This requirement is for identification purposes in the administration of the motor carrier property tax as per the Social Security Privacy Act and SC Regulation.

Can I make a split payment for the motor carrier property tax?

Yes, if the PT-442 form is filed by June 30th, the law allows for the tax payment to be split. At least one-half of the tax must be paid with the return, and the balance must be settled on or before December 31st of the same year.

What should I do if my vehicle has Farm (FM) or Special Mobile (SM) tags?

For vehicles with FM or SM tags, the property taxes should be directed to the County, not the Department of Revenue. The PT-442 form should not include these vehicles unless otherwise specified.

How long should I keep records related to the PT-442 form?

It is advisable to keep a copy of the PT-442 form and all related tax records for at least three years. These records are essential for substantiating the information provided on the tax return in case of audits or queries by the Department of Revenue.

Common mistakes

When completing the PT-442 Application for Motor Carrier Property Tax form, accuracy and attention to detail are crucial to ensure successful processing by the South Carolina Department of Revenue. Here are ten common mistakes individuals should avoid:

- Not using blue or black ink: The instructions specify that only blue or black ink is acceptable. Using other colors or pencil can lead to processing delays or errors.

- Entering a P.O. Box for the physical location: The form requires a physical address for the location of the business, not a P.O. Box. This mistake can cause confusion regarding the actual business location.

- Omitting the Federal Identification Number (FEI) or Social Security Number (SSN): An FEI or SSN is mandatory for processing the form. Failure to include it can result in an inability to process the return.

- Incorrect reporting of vehicle tags: Special Mobile (SM) and Farm (FM) tags have specific tax implications. Incorrectly identifying tag types can affect where and how taxes are paid.

- Failing to list all owned vehicles: All vehicles owned as of December 31, 2003, must be reported. Omitting vehicles can lead to underreporting and potential penalties.

- Incorrectly handling sold or repossessed vehicles: For vehicles sold or repossessed before December 31, 2003, documentation must be attached. Not doing so can result in incorrect tax assessments.

- Not consolidating returns for multiple vehicles: When possible, all vehicles should be reported on one return. Filing multiple returns when not necessary can complicate the filing process.

- Making errors in the credit balance section: When claiming a credit balance, it's important to ensure accuracy. Mistakes can lead to incorrect tax liabilities being assessed.

- Forgetting to update records with new account information: New accounts must complete the PT-442 to update records. Failure to return this form can lead to outdated information in the system.

- Poor record-keeping: Not keeping a copy of the filled-out form and related documentation can create challenges if the submitted information is questioned or an audit is conducted.

In summary, careful attention to filling out the PT-440 form correctly is essential to comply with the tax requirements and avoid potential issues with South Carolina's Department of Revenue.

Documents used along the form

When managing motor carrier property tax matters in South Carolina, particularly with the Application for Motor Carrier Property Tax form PT-442, individuals and businesses often find themselves needing additional forms and documents. These serve a variety of purposes, from confirming vehicle status to adjusting tax obligations. Below is a list of documents that are frequently utilized in conjunction with the PT-442 form to ensure compliance and accuracy in tax filings.

- Bill of Sale: This document provides proof of the sale of a vehicle. It is essential for those who have sold a vehicle prior to December 31 of the previous year to confirm that they no longer own the vehicle and, therefore, are not liable for the tax for the subsequent year.

- Repossession Confirmation: This is a letter or document from a financial institution confirming the repossession of a vehicle. It must include the date the vehicle was repossessed to prove the individual or business no longer had possession and, thus, tax responsibility as of December 31.

- PT-441 Motor Carrier Property Tax Return: The main form used for reporting all vehicles that are subject to property tax, detailing each vehicle owned or leased with a gross vehicle weight greater than 26,000 pounds or BC-tagged buses.

- Schedule PT-453 (VIN Schedule): A detailed list that must be completed with the purchase date and price for all vehicles listed in the PT-441. It helps to further specify the tax obligations for each vehicle in the fleet.

- Credit Balance Documentation: Records showing any credit balance from the previous year that can be applied to the current year's tax liability. This is crucial for managing ongoing tax expenses effectively.

- FEI/SSN Documentation: Official documentation providing the Federal Employer Identification (FEI) or Social Security Number (SSN) required for processing the return. These numbers are essential for identifying the tax accounts precisely.

- Proof of Address Change: If the address has changed since the previous filing, new documentation proving the current address is necessary to update the Department of Revenue's records accurately.

- Ownership or Partnership Agreement: Documents that confirm the legal structure of the business (like sole proprietorship, partnership, LLC/LLP) and the percentage of ownership if applicable. This affects the liability and responsibility for tax filings.

- Vehicle Registration Documents: Official state documentation that lists each vehicle's registration details, including weight class and any special tags (e.g., SM or FM tags) that could affect tax calculations.

- Request for Refund: If the county charged property taxes for vehicles required to be reported on the PT-441 or PT-442 forms, a formal request for a refund from the county might be necessary.

Each of these documents plays a vital role in the accurate and effective management of motor carrier property taxes in South Carolina. They ensure that all tax obligations are met according to state laws and regulations while providing the necessary evidence for any claims or adjustments. It's important for individuals and businesses to be aware of these documents and to keep them readily available when preparing their tax filings.

Similar forms

The PT-442 form is analogous to the Internal Revenue Service's (IRS) 2290 Form, also known as the Heavy Highway Vehicle Use Tax Return. Both forms focus on vehicles used for business purposes but differ in their tax implications. The 2290 Form is required for heavy vehicles operating on public highways, assessing taxes based on vehicle weight, whereas the PT-442 form is specific to motor carriers in South Carolina, levying property tax based on vehicle ownership and usage within the state. Despite these differences, both documents serve as essential tax filings for vehicles operating under certain conditions, emphasizing the vehicle's weight and usage.

Similarly, the PT-442 form shares common grounds with the Uniform Carrier Registration (UCR) Application. The UCR Application is a federal mandate requiring entities engaged in interstate or international commerce to register their business and pay an annual fee. Like the PT-442, it targets businesses utilizing vehicles for transportation; however, the PT-442 is more narrowly focused on tax obligations within South Carolina, whereas the UCR has broader implications for carrier registration across state lines. Both forms ensure that carriers are adequately registered and comply with tax laws, though they operate under different jurisdictions.

The Schedule C (Form 1040) or "Profit or Loss from Business" is another document resembling the PT-442 form in its target audience of business owners. Owners of corporations or sole proprietorships use Schedule C to report their profits or losses to the IRS. While Schedule C pertains more to general business income and expenses, the PT-442 specifically addresses the property tax responsibilities of motor carriers in South Carolina. Both documents are critical for tax preparation, ensuring businesses accurately report their financial activities.

Another example is the State of South Carolina Business Personal Property Tax Return, which, like the PT-441, is aimed at entities operating within South Carolina. This form assesses taxes on personal property used in a business, such as equipment and machinery. The PT-442 form's primary focus is on motor carriers and their vehicles, marking a specific subset within the broader category of business personal property. Both forms are pivotal in calculating tax liabilities based on business assets within the state.

The Quarterly Federal Excise Tax Return (Form 720) issued by the IRS also parallels the PT-442 in certain aspects. Form 720 is utilized by businesses to report excise taxes on specific goods, services, and activities, which can include transportation-related taxes. The PT-442, focusing solely on motor carrier property tax within South Carolina, highlights the state-level obligations carriers have based on their vehicle fleet. Both forms are instrumental for businesses to fulfill their tax duties on operations subject to excise taxes.

Form MCS-150, or the Motor Carrier Identification Report, is necessary for updating the Federal Motor Carrier Safety Administration (FMCSA) on information about a carrier's operations. Although it is primarily a safety and operational tool rather than a tax document, it shares the commonality with the PT-442 of being required for businesses operating vehicles for transport. The PT-442 concentrates on the tax aspect within South Carolina, while MCS-150 ensures carriers nationwide are correctly identified for safety monitoring.

The Business License Application in many states shares similarities with the PT-442 form in its applicability to businesses operating within a specific jurisdiction. While business licenses are more about legal permission to operate in a locale, and the PT-442 deals specifically with tax obligations of motor carriers, both forms are crucial for businesses to legally and financially operate within their respective scopes. This juxtaposition highlights the multifaceted compliance requirements businesses face at the state level.

Lastly, the Application for Employer Identification Number (EIN), also known as Form SS-4 in the IRS catalog, is used by entities to apply for an EIN number. This number is essential for businesses to be identified for tax purposes, similar to how the PT-442 form identifies motor carriers for property tax assessments in South Carolina. While SS-4 facilitates a broader range of business activities and tax responsibilities beyond just property tax, it is fundamentally about ensuring businesses are properly registered and identifiable to tax authorities, akin to the PT-442's goals.

Dos and Don'ts

When it comes to filling out the PT-442 form for Motor Carrier Property Tax in South Carolina, accuracy and thoroughness are paramount. Here are some essential dos and don'ts to guide you through the process:

- Do use blue or black ink as specifically requested in the instructions. This ensures that the document is legible and adheres to the official filing requirements.

- Do not use a post office box for the physical location address. The form requires a physical street address to correctly associate your business location with county tax requirements.

- Do thoroughly review the entire form before submission to ensure that all information is accurate and complete. Inaccurate or incomplete forms can lead to delays or incorrect tax assessments.

- Do not include vehicles that were not owned or leased as of December 31, 2003, for tax returns pertaining to the calendar year 2003. This ensures compliance with the specific tax year and avoids confusion or misreporting.

- Do attach additional documentation when necessary, such as a bill of sale for vehicles sold before December 31, 2003, or confirmation from a financial institution for repossessed vehicles. This documentation supports your tax return and clarifies ownership status.

- Do not discard any additional returns received; instead, use the one with the file number under which you filed for the tax year 2002, and indicate on the others the file number used. This consolidates your tax filing and ensures all vehicles are reported under one return.

- Do make sure to include your Federal Identification Number (FEI) or Social Security Number (SSN) as required. These identifiers are crucial for processing your return and linking it to the correct tax account.

- Do not overlook the record-keeping recommendation. Keeping a copy of the filed return and all supporting records for at least three years is instrumental in case of audits or questions regarding your filed return.

Adhering to these guidelines when completing the PT-442 form can streamline the process and help ensure that your Motor Carrier Property Tax responsibilities are met accurately and on time.

Misconceptions

Understanding the PT-442 form and its implications is essential for motor carriers operating within South Carolina. However, misconceptions can lead to confusion and compliance issues. Here are ten common misconceptions about the PT-442 form:

- The PT-442 form is only for large corporations. In reality, this form applies to all motor carriers operating in South Carolina, regardless of their business size or ownership structure, including sole proprietors, LLCs/LLPs, partnerships, and corporations.

- Vehicles purchased in 2004 should be included on the form. Contrary to this belief, only vehicles owned or leased as of December 31, 2003, are required to be reported for the 2003 tax year. Vehicles purchased in 2004 are not included.

- Special Mobile (SM) tags mean you must file with the Department of Revenue. Actually, if your vehicles have SM tags, the property taxes should be paid to the County, not the Department of Revenue.

- Farm tags are processed the same way by the Department of Revenue as other vehicles. Since the calendar year 2000, there have been changes, and vehicles with FM tags have their property taxes managed by the County.

- A Federal Identification Number is not crucial if you're an individual owner. Regardless of being an individual owner or a corporation, a Federal Identification Number (FEI) or Social Security Number (SS) is mandatory for processing the return.

- Each vehicle should have its own return filed. The Department of Revenue encourages consolidating all vehicular information into one return to streamline the process, although they are working on a method to make this consolidation easier.

- Selling a vehicle before December 31, 2003, nullifies tax liabilities. It's essential to attach a copy of the Bill of Sale to the PT-441 to document the sale. Otherwise, taxes for 2003 are still due regardless of the sale.

- Repossessed vehicles before December 31 do not require tax payment. Written confirmation from the financial institution is needed to prove repossession before December 31 for tax exemption.

- Credit balance from a previous year can't be used. If there's a credit balance from the calendar year 2002, it can be used against the current tax liability on Line 8 of the form.

- Taxes paid to the county can't be refunded. If property taxes were mistakenly paid to the county for vehicles that should have been reported on this return, contacting the county auditor’s office for a refund is recommended.

Understanding these aspects clarifies the requirements and procedures related to the PT-442 form, aiding motor carriers in achieving compliance with South Carolina's tax laws.

Key takeaways

Understanding the intricacies of the Application for Motor Carrier Property Tax form PT-442 is essential for motor carriers operating within South Carolina. Here are several key takeaways that ensure the correct completion and usage of this specific form:

- The form PT-442 needs to be accurately filled out and submitted to the South Carolina Department of Revenue for any motor carrier operating vehicles with a gross vehicle weight greater than 26,000 pounds or buses for hire with a BC tag that are capable of carrying 16 or more passengers, including the driver. Inter-City buses are exempt from this requirement.

- It is mandatory to provide a Federal Identification Number (FEI) for corporations and partnerships or a Social Security Number (SSN) for individuals and sole proprietors. This information is crucial for the identification and processing of the return.

- Vehicles owned or leased as of December 31 of the year prior to the tax year in question must be reported on the form. It is important to not include vehicles purchased in the current tax year.

- The PT-442 form also requests detailed information about the business owning the vehicles, including the legal name of the owner/corporation, the business name, and the physical and mailing addresses. This ensures the tax assessment is accurately directed to the proper entity.

- For vehicles that have been sold or repossessed before December 31 of the relevant tax year, proper documentation such as a bill of sale or written confirmation from the financial institution must be attached to the PT-442 form.

- The PT-442 allows for a credit balance from the prior year's return to be applied against the current tax liability. Keeping accurate records of these transactions is essential for future verification and audit purposes.

- In case the county has charged property taxes for vehicles required to be reported on the PT-442 form, it is the taxpayer’s responsibility to contact the county auditor's office for a refund. The PT-442 form does not allow credit for taxes paid to the county.

Accurate completion and timely submission of the PT-442 form not only comply with South Carolina’s Department of Revenue requirements but also ensure that motor carrier operators are correctly assessed for property taxes, avoiding unnecessary penalties or fees. Additionally, maintaining detailed records and receipts related to the PT-442 submissions can provide essential documentation in case of an audit.

More PDF Templates

Beer and Wine License Cost - The necessity to renew the license annually through the form promotes ongoing professional development and adherence to up-to-date practices.

Sc Dss Forms - Renew your insurance assistance by providing updated information on the DHEC 1548 form.

How Long Is a Tb Test Good for Teachers - It helps in documenting exemptions and special cases, such as individuals with a history of BCG vaccination or previous TB infection.