Fill Your Sc1040X Template

Making corrections to a previously filed state income tax return can seem daunting, but understanding the SC1040X form can simplify this process for residents of South Carolina. Meant for amendments of individual income tax returns, the SC1040X is a crucial document for taxpayers who need to adjust their filings due to various reasons such as omitted income, incorrect claims for deductions or credits, or changes in filing status. It takes into account different components of the initial filing, from federal taxable income adjustments to South Carolina tax payable, and even specific credits such as the Child and Dependent Care Credit. The form becomes necessary after the original state return has been filed and is particularly important if there have been subsequent audits by the IRS affecting the state tax liability. Detailed information about the taxpayer, including changes in personal details and explanations of the amendments, is required to ensure accurate processing and to avoid delays. Furthermore, the form is designed to accommodate both residents and nonresidents, with special instructions for those living outside South Carolina during the tax year. Completing the SC1040X is a step towards ensuring one's tax records accurately reflect their financial situation, potentially leading to refunds or additional tax due.

Document Example

1350

PART I

|

|

STATE OF SOUTH CAROLINA |

|

|

SC1040X |

||||||||||||||||

|

|

DEPARTMENT OF REVENUE |

|

|

|||||||||||||||||

dor.sc.gov |

|

AMENDED INDIVIDUAL INCOME TAX |

|

|

(Rev. 8/15/19) |

||||||||||||||||

|

Fiscal year ended |

- |

- |

|

|

, or calendar year |

|

|

|

|

3083 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print your first name and middle initial |

Last name |

|

|

|

|

|

Suffix |

|

Deceased |

|

|

Tax Year |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Check if |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's first name and middle initial, if married filing jointly Spouse's last name, if different |

|

Check if |

|

Your Social Security Number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Deceased |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Mailing address (number and street, or PO Box) |

|

|

|

Apt. |

|

|

Area code |

Daytime phone |

|

Spouse's Social Security Number |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP |

|

|

|

|

County code |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if address |

Foreign country address including postal code (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

is outside US |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach Check Here

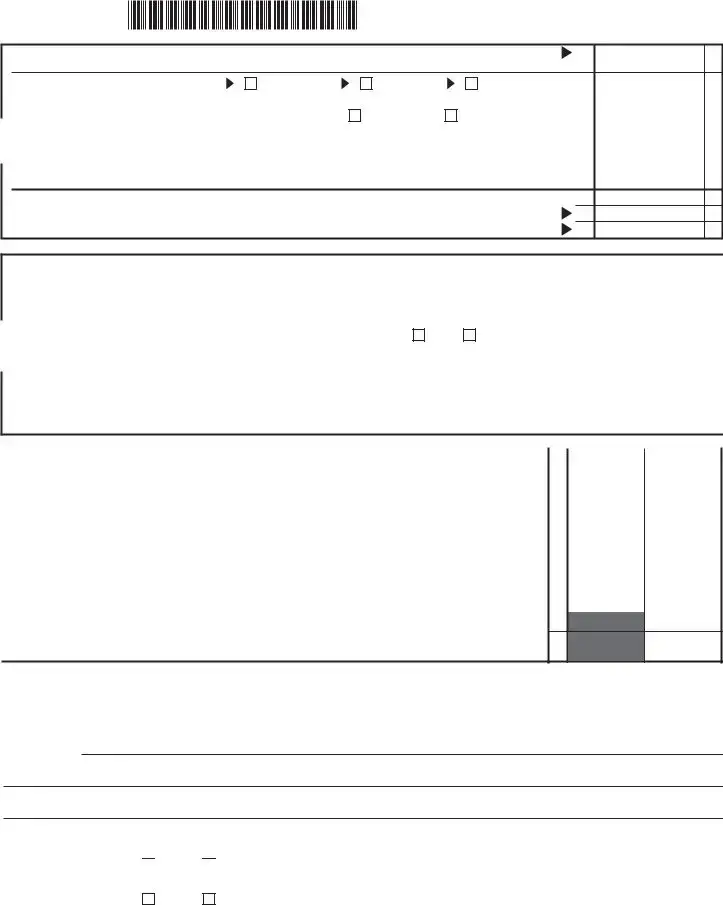

PART II

Attach W2s, if applicable

Filing status: |

Single |

Married filing jointly |

Married filing separately |

Head of household |

Qualifying widow(er) |

Federal exemptions/dependents: Number of exemptions/dependents on your federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

|

|

Mail to: SCDOR, |

|

|

A |

|

|

B |

|

|

C |

||

|

Amended Individual Income Tax, |

|

|

Original amount |

|

Net Change - amount of |

|

|

Correct |

|||||

|

|

|

or as previously adjusted |

|

increase or (decrease) |

|

|

Amount |

||||||

|

PO Box 101104, Columbia, SC |

|

|

|

|

|

explained in Part V |

|

|

|

|

|||

|

Income |

1. |

Federal taxable income |

1 |

|

00 |

1 |

|

00 |

|

1 |

|

00 |

|

|

|

SC1040 line 1 |

|

|

|

|

||||||||

|

and |

2. |

Net South Carolina adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Adjustments |

2 |

|

00 |

2 |

|

00 |

|

2 |

|

00 |

||||

|

|

|

(SC1040 line 2 minus SC1040 line 4) |

|

|

|

|

|||||||

|

|

3. |

Modified South Carolina |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

taxable income (add line 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and line 2); Nonresident - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter amount from Part IV, |

|

|

|

00 |

|

|

00 |

|

|

|

00 |

|

|

|

line 34 of this form |

3 |

|

3 |

|

|

3 |

|

||||

|

Tax |

4. |

South Carolina tax |

4 |

|

00 |

4 |

|

00 |

|

4 |

|

00 |

|

|

|

5. |

Other taxes (see instructions) . |

5 |

|

00 |

5 |

|

00 |

|

5 |

|

00 |

|

|

|

6. |

Total South Carolina tax (add |

|

|

|

00 |

|

|

00 |

|

|

|

00 |

|

|

|

line 4 and line 5) |

6 |

|

6 |

|

|

6 |

|

||||

|

Credits |

7. |

Child and Dependent Care |

7 |

|

00 |

7 |

|

00 |

|

7 |

|

00 |

|

|

|

|

Credit |

|

|

|

|

|||||||

|

|

8. |

. . .Two Wage Earner Credit |

|

8 |

|

00 |

8 |

|

00 |

|

8 |

|

00 |

|

|

9. |

Other nonrefundable |

9 |

|

00 |

9 |

|

00 |

|

9 |

|

00 |

|

|

|

|

credits |

|

|

|

|

|||||||

|

|

10. |

Total credits (add line 7 |

|

|

|

00 |

|

|

00 |

|

|

|

00 |

|

|

|

through line 9) |

10 |

|

10 |

|

|

10 |

|

||||

|

Payments |

11. |

Balance: Subtract line 10 from |

11 |

|

00 |

11 |

|

00 |

|

11 |

|

00 |

|

|

|

line 6 |

|

|

|

|

||||||||

|

and |

12. |

South Carolina tax withheld |

|

|

|

00 |

|

|

00 |

|

|

|

00 |

|

|

(from |

12 |

|

12 |

|

|

12 |

|

|||||

|

|

|

|

|

|

|

||||||||

|

Transfers |

13. |

South Carolina Estimated Tax |

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

00 |

13 |

|

00 |

|

13 |

|

00 |

||||

|

|

|

payments |

|

|

|

|

|||||||

|

|

14. |

Tuition Tax Credit and other |

|

|

|

00 |

|

|

00 |

|

|

|

00 |

|

|

15. |

refundable credits |

14 |

|

14 |

|

|

14 |

|

||||

|

|

Amount of tax paid with extension; |

original return; and any additional tax paid after |

|

|

|

|

|

||||||

|

|

|

original was filed |

. . |

. . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . . . . . . . |

. . |

|

15 |

|

00 |

|

|

|

16. |

. .Total of line 12, column C through line 15, column C |

. . . |

. . |

. . . . . . . . . . . . . . . . . . |

|

16 |

|

00 |

||||

|

|

17. |

Net refund from original return |

|

. . |

. . . . . . . . . . . . . . . . . |

. . |

. . . |

. . . . . . . . . . . . . . . . |

. . |

|

17 |

|

00 |

|

|

18. |

. . . . . . . . . . . . .Balance: Subtract line 17 from line 16 |

. . . |

. . . |

. . . . . . . . . . . . . . . . |

. . |

|

18 |

|

00 |

|||

|

|

19. |

Amount of Use Tax from online, |

19 |

|

00 |

||||||||

|

|

|

on original return |

. . |

. . . . . . . . . . . . . . . . . |

. . . |

. . |

. . . . . . . . . . . . . . . . |

. . |

|

|

|||

|

|

20. |

Transfer from original return for Estimated Tax and/or any contribution |

20 |

|

00 |

||||||||

|

|

21. |

. . . . . .Add line 19 and line 20 |

|

. . . |

. . . . . . . . . . . . . . . . |

. . . |

. . |

. . . . . . . . . . . . . . . . |

. . . |

. . |

21 |

|

00 |

|

|

22. |

Subtract line 21 from line 18 (net tax) |

. . . |

. . . |

. . . . . . . . . . . . . . . . |

. . |

. . |

22 |

|

00 |

|||

Complete and sign page 2.

PART II

Refund 23. If line 22 is larger than line 11, column C, subtract and enter the difference . . REFUND |

23 |

|||||||

Refund |

|

(line 23a check box entry is required) |

Debit Card |

Paper Check |

||||

23a. Mark one refund choice: |

(23b required) |

|

||||||

Options |

|

|

Direct Deposit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(subject to |

|

|

|

|

|

|

|

|

23b. Direct Deposit (for US accounts only) Type: |

Checking |

Savings |

|

|||||

program |

|

|

|

|

|

|

|

|

limitations) Routing Number (RTN) |

|

|

RTN must be 01 through 12 or 21 through 32 |

|

||||

|

|

|

|

|

Must be 9 digits. The first two numbers of the |

|

||

|

Bank Account Number (BAN) |

|

|

|

|

|

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

Balance 24. |

If line 11, column C is larger than line 22, enter the difference |

24 |

||||||

Due |

25. |

Interest and penalty on tax due (from due date of original return) |

25 |

|||||

|

26. |

Total: Add line 24 and line 25 and enter here |

. . . . . . . . . . . . . TOTAL BALANCE DUE |

26 |

||||

00

00

00

00

PART III

Please |

I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief. |

||||||||||

Sign |

|

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

|

|

|

|

Your signature |

Date |

|

|

Spouse's signature (If filing jointly, both must sign.) |

|

|

||||

I authorize the Director of the SCDOR or delegate to discuss this return, Yes |

|

|

No |

Preparer's printed name |

|

|

|||||

|

|

|

|

|

|||||||

attachments, and related tax matters with the preparer. |

|

|

|

|

|

|

|

|

|

||

Paid |

|

If prepared by a person other than the taxpayer, this declaration is based on all information of which preparer has any knowledge. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's |

|

|

|

|

|

|

|

|

|

||

Prepared by |

Date |

Address |

|

|

|

||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PTIN or FEIN |

Phone |

City |

State |

ZIP |

||||||

PART IV - NONRESIDENT (It is best to make necessary corrections on a new Schedule NR |

|

(1) As Originally |

(2) Correct |

|

before completing the nonresident section of the SC1040X.) |

|

Reported |

Amount |

|

27. |

Federal adjusted gross income |

|

|

|

27 |

|

|

||

28. |

South Carolina adjusted gross income |

|

|

|

28 |

|

|

||

29. |

Corrected proration (line 28, column 2 divided by line 27, column 2) |

29 |

|

% |

30. |

Total deductions and exemptions (see instructions) |

30 |

|

|

31. |

Allowable deductions and exemptions (multiply line 30, column 2 by line 29) |

|

|

|

31 |

|

|

||

32. |

Total South Carolina adjustments |

32 |

|

|

33. |

Subtract line 32, column 2 from line 31 |

|

|

|

33 |

|

|

||

34.Modified South Carolina taxable income as corrected (subtract line 33 from line 28, column 2)

Enter amount on line 3 column C on front of SC1040X |

34 |

PART V - EXPLANATION OF CHANGES Enter the line reference from PART II or PART IV for which you are reporting a change and give the reason for each change. Attach applicable documentation.

Failure to provide an explanation or supporting documentation will result in a delay in processing your return.

Explanation:

Have you been notified that your original state return is being or will be audited by the SCDOR?

Have you been notified that your original state return is being or will be audited by the SCDOR?

Yes

Yes  No

No

Are you filing this amended return due to a federal adjustment? If yes, attach a copy of the federal audit or

Are you filing this amended return due to a federal adjustment? If yes, attach a copy of the federal audit or

adjustment. |

Yes |

No |

FILING AMENDED RETURNS

For tax years 2018 and before, use the SC1040X to correct or change the SC1040 that you have previously filed. For tax year 2019 and later, amend your return using the SC1040, marking the amended return check box and attaching the Schedule AMD. An amended return can be filed only after you have filed an original return. By filing an amended return you are correcting our tax records. An amended return is necessary if you omitted income, claimed deductions or credits you were not entitled to, failed to claim deductions or credits you were entitled to, or changed your filing status. You should also file an amended return if you were audited by the IRS (unless the IRS audit had no impact on your state return). Your amended return may result in either a refund or additional tax. You must pay any additional tax with the amended return. Furnish all information requested. When items are in question, refer to the instructions for preparing the SC1040, SC1040TC,

NOTE: South Carolina law does not allow a net operating loss carryback.

If you filed your original return by the original due date or by an extended due date, if applicable, you must file any claim for refund within either:

•three years from the date of filing, or

•three years from the original due date, or

•two years from the date of payment

If you filed your original return after the original due date and any extended due date, if applicable, you must file any claim for refund within either:

•three years from the original due date, or

•two years from the date of payment

When amending a return for tax year 2018 and before, use the most current revision of the SC1040X regardless of tax year. Use the Tax Tables, SC1040TT, for the tax year that is being amended. Find forms at dor.sc.gov/forms.

INSTRUCTIONS

PART I - Taxpayer Information

•Enter the tax year in the space provided.

•Complete name and Social Security Number for each taxpayer included in this return.

•Provide most current mailing address including county code and phone number.

•For a foreign address, check the box indicating the address is outside of the US. In the box provided, print or type the complete foreign address including postal code.

•Mark the appropriate box for filing status. Generally, the filing status should be the same as the filing status used on your federal return.

•You cannot change your filing status from joint to separate returns after the due date of the original return has passed.

•Enter the number of exemptions/dependents claimed on your federal return.

•Beginning with tax year 2018, exemptions are eliminated on the federal return. For tax year 2018, enter the number of dependents claimed on the federal return.

PART II - Return Information

Columns A Through C

Column A: Enter the amounts from your original return for line 1 through line 14 using figures reported or adjusted on your original return.

Column B: Enter the net increase or decrease for each line you are changing. Explain each change in Part V.

Column C: To calculate the amounts to enter in this column:

•Add the increase in column B to the amount in column A, or

•Subtract the decrease in column B from the amount in column A.

For any amount you do not change, enter the amount from column A in column C. Show any negative numbers (losses or decreases) in Columns A, B, or C in parentheses.

NOTE: Nonresident/part year resident taxpayers should complete Part IV prior to completing line 3 through line 26 of the SC1040X. Line 1 and line 2 do not apply to nonresident/part year residents.

1

The following instructions refer to line numbers in Column C. If no changes are to be made to line 1 through line 14, use the amounts from the original return.

Line 1: Enter the corrected federal taxable income.

Line 2: Enter the net amount of the changes to the additions (SC1040, line 2) or subtractions (SC1040, line 4) from federal taxable income.

Line 3: Enter the modified South Carolina taxable income (add line 1 and line 2). Nonresidents should enter amount from Part IV, line 34 of this form.

Line 4: Use the tax tables for the tax year being amended to determine the corrected tax amount. Enter the amount on line 4.

Line 5: Make any necessary changes to the tax on lump sum distributions (attach corrected SC4972), the tax on active trade or business (attach corrected

Line 6: Add line 4 and line 5. Enter the amount on line 6. This is the total South Carolina tax liability.

Lines 7 - 9: Enter the corrected credit amounts.

Line 10: Add line 7 through line 9. Enter the amount on line 10.

Line 11: Subtract line 10 from line 6 and enter the amount on line 11.

Line 12: Enter the corrected South Carolina withholding amounts. Attach supporting

Line 13: Enter the corrected South Carolina Estimated Tax payment amount.

Line 14: Enter the corrected Tuition Tax Credit or other refundable credit amount. Attach the appropriate corrected credit form.

Line 15: Enter the total tax paid with a South Carolina extension and/or original return and any additional payments on line 15.

Line 16: Add Column C line 12 through line 15. Enter the total on line 16.

Line 17: Enter the net refund amount from the original return. Do not include Estimated Tax transfers or contribution

Line 18: Subtract line 17 from line 16 and enter the amount on line 18.

Line 19: Enter the amount of Use Tax paid for online,

Line 20: Enter the amount of transfers from the original return for Estimated Tax and/or contribution

Line 21: Add line 19 and line 20. Enter the amount on line 21.

Line 22: Subtract line 21 from line 18 and enter the amount on line 22. This is the net tax.

Line 23: If line 22 is larger than Column C line 11, subtract line 11 from line 22 and enter the difference on line 23. This is the amount to be refunded to you. Overpayments cannot be transferred to another tax year. Mark your refund choice on line 23a.

Line 23a: You have three ways to receive your refund. You can choose direct deposit to have the funds deposited directly into your bank account (the fastest option for most filers), or you can choose to have a debit card or a paper check mailed to you. Debit cards are issued by Bank of America and are subject to program limitations. Mark an X in one box to indicate your choice. If you choose direct deposit, you must enter your account information on line 23b.

2

Line 23b:

Line 24:

Line 25:

Line 26:

If you choose direct deposit, enter your account information on line 23b for a fast and secure direct deposit of your refund. If you don't enter complete and correct account information, we’ll mail you a paper check. Direct deposit is not available for bank accounts located outside the United States.

Mark an X in the box for the type of account, checking or savings.

Enter your bank’s

Enter your bank account number (BAN) in the space provided. The number can contain up to 17 alphanumeric digits. If fewer than 17 digits, enter the number from left to right. Do not enter hyphens, spaces, or special symbols. Do not include the check number.

Contact your bank if you need to verify that your bank account information is accurate prior to submitting your return. If we cannot make the direct deposit for any reason, we will send a paper check to the mailing address on your return. To avoid delays, be sure your mailing address is complete and accurate on your return.

If Column C line 11 is larger than line 22, subtract line 22 from line 11. Enter the difference on line 24.

If this amended return results in a balance due, penalties and/or interest may apply. You will be notified of any additional amounts owed but not paid.

Add line 24 and line 25. Enter the amount on line 26. This is your total balance due. Payment should be attached to Part II of this form.

PART III - Signature

Provide signatures and dates. Both spouses must sign when filing married filing jointly.

Paid preparers should provide all requested information.

PART IV - Nonresidents

It is best to make necessary corrections on a new Schedule NR before completing the nonresident section of the SC1040X. These

corrected schedules should be kept with your records and should not be attached to the SC1040X. Explanation of changes

should be included in Part V.

Complete Column 1 line 27 through line 34 in Part IV using figures reported or adjusted on your original return.

The following instructions refer to line numbers in Column 2 of Part IV. If no changes are to be made to line 27 through line 33, use the amounts from the original return.

Line 27: Enter the amount of federal adjusted gross income from the corrected Schedule NR, column A.

Line 28: Enter the amount of South Carolina adjusted gross income from corrected Schedule NR, column B.

Line 29: Divide line 28, column 2 by line 27, column 2.

Line 30: Enter the total amount of itemized or standard deduction and total exemptions from the corrected Schedule NR.

Line 31: Multiply line 30, column 2 by the corrected proration on line 29 to determine the amount of itemized or standard deduction and exemption applicable to South Carolina.

Line 32: Enter the total South Carolina adjustments from Schedule NR.

Line 33: Subtract line 32, column 2 from line 31.

Line 34: Subtract line 33 from line 28, column 2. Enter this amount on SC1040X line 3, column C as the corrected South Carolina taxable income. This amount should equal your SOUTH CAROLINA TAXABLE INCOME on the corrected Schedule NR. Continue with the line number instructions for line 4 of the SC1040X.

3

PART V - Explanation of Changes

Any changes made to the original return need to be explained in this section. Enter the line reference from Part II or Part IV for which you are reporting a change and give the reasons for each change. Attach supporting documentation.

•Failure to provide a detailed explanation may result in a delay in processing your amended return.

•A change in state tax withholding must be verified by a

•Tax credits for taxes paid to other states must be verified by a copy of the other state's Income Tax return and federal return.

•Other nonrefundable credits must be supported by a properly completed South Carolina form or schedule.

•Refundable credits must be supported by providing the properly completed South Carolina form.

Mail to: SCDOR, Amended Individual Income Tax, PO Box 101104, Columbia, SC

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

4

Form Properties

| Fact | Detail |

|---|---|

| Form Purpose | The SC1040X is used to amend a previously filed SC1040 individual income tax return for residents of South Carolina. |

| Applicable Tax Years | For tax years 2018 and prior, the SC1040X is utilized. For tax year 2019 and onwards, amendments are made through the SC1040 with an amended return check box. |

| Nonresident Adjustments | Nonresidents or part-year residents making amendments must do so by correcting a new Schedule NR before adjusting their SC1040X. |

| Refund Options | Taxpayers can receive refunds via direct deposit, debit card, or paper check, with direct deposit being the quickest method. |

| Governing Law | The processing and rules for the SC1040X form are governed by South Carolina state law, including statutes related to tax filing deadlines, refunds, and amendments. |

Guide to Writing Sc1040X

Filing an amended tax return often follows the realization that initial filings were incomplete or contained discrepancies that could affect one's tax liability or refund. Amending a tax return ensures that these issues are corrected, whether they originated from omitted income, incorrect deductions or credits, changes in filing status, or as a result of federal adjustments. Accurate completion of the SC1040X form is crucial for these amendments. The steps detailed below are designed to guide individuals through the process of accurately completing and submitting the SC1040X form to the State of South Carolina Department of Revenue.

- Part I: Start by entering the relevant tax year at the top of the form. Provide your name, Social Security number, and, if applicable, your spouse’s details as requested. Ensure you check the appropriate boxes if there are any changes in circumstances such as deceased taxpayer or spouse.

- Address Details: Fill in your current mailing address. If you have a foreign address, make sure to check the box indicating so and include the full address with the postal code.

- Filing Status and Exemptions: Mark your filing status as per your federal return. Input the number of federal exemptions or dependents claimed.

- Part II: This section requires careful attention. You will need to fill out three columns:

- Column A with the amounts from your original return.

- Column B for the net change (increase or decrease).

- Column C with the corrected amounts, which are a result of modifications in Column B.

- Ensure to attach any W-2s or 1099s if your South Carolina withholding amounts have changed.

- Refund or Amount Due: Determine if you are due a refund or owe additional tax. Mark your refund preference and provide the necessary banking information for direct deposit, or select the paper check or prepaid debit card option.

- Part III - Signatures: Complete the form by signing and dating the bottom. If filing jointly, both spouses must sign.

- Part IV - Nonresidents: If you are a nonresident or part-year resident, you'll need to adjust your income according to your time spent in South Carolina. Refer to a new Schedule NR for corrections before entering the relevant information in this section.

- Part V - Explanation of Changes: Clearly explain the reasons for each change. If amending due to a federal adjustment, attach a copy of the federal audit or adjustment notice. List each change and its corresponding justification.

- Before mailing, double-check all entries and attachments for accuracy. Mail your completed SC1040X form along with any required documentation to the address provided at the top of the form to ensure it reaches the South Carolina Department of Revenue correctly.

Once your amended return is filed, the South Carolina Department of Revenue will process your amendments and corrections. This could result in an adjusted tax refund or amount due. It's important to remember that filing an amended return accurately and thoroughly can help avoid delays or additional audits. Keep copies of all documents you submit for your records.

Understanding Sc1040X

What is the SC1040X form used for?

The SC1040X form is used to amend a previously filed South Carolina individual income tax return. Taxpayers may need to file an amended return if they need to correct income, deductions, credits, or filing status on their original state tax return. This form allows individuals to make necessary corrections to ensure their tax information is accurate and to comply with state tax laws.

When should I file an SC1040X?

An SC1040X should be filed after the original tax return has been submitted and you have discovered errors or omissions that affect your South Carolina tax liability. This includes needing to report additional income, claim additional deductions or credits, correct the amount of tax owed, or change your filing status. It is also necessary to file an amended return if the IRS has audited your federal return and the changes affect your state return.

Can I file the SC1040X electronically?

As of the latest available information, you need to mail the SC1040X form to the South Carolina Department of Revenue. Electronic filing of the amended return may not be available. Taxpayers are advised to check the South Carolina Department of Revenue's website or contact them directly for the most current filing options.

What documentation do I need to attach to the SC1040X?

When filing an SC1040X, you should attach any documents that support the changes you are making. This includes W-2s, 1099s, federal 1040X if you amended your federal return, and any other relevant schedules or documentation that support your adjustments. Proper documentation will help ensure the amended return is processed smoothly.

How will I know if the Department of Revenue has received and processed my SC1040X?

Once your SC1040X is processed, the South Carolina Department of Revenue will send you a notice or amended return summary indicating the adjustments that were made. If you wish to verify receipt and processing status before then, you may contact the Department of Revenue directly. Providing a daytime phone number on your form can also help the department reach you if there are any questions.

Can I change my filing status on the SC1040X?

You cannot change your filing status from a joint return to separate returns after the due date of the original return. However, if your original return was filed with an incorrect status, you may use the SC1040X to correct it. Be mindful that your filing status on the amended return usually needs to match what you used on your federal return, unless state law dictates otherwise.

What if I need to amend a return for a tax year prior to 2018?

For tax years 2018 and before, you must use the SC1040X form to amend a return. Regardless of the tax year you are amending, use the most current version of the SC1040X. Be sure to use the tax tables for the specific tax year you are amending to calculate the correct amount of tax due. This ensures your amendment adheres to the tax laws applicable for that year.

Is there a deadline for filing an SC1040X?

Yes, there is a timeframe for filing an amended return to claim a refund. You must file the SC1040X within three years from the date of filing the original return, three years from the original due date of the return, or two years from the date you paid the tax, whichever is later. If filing after the original due date, additional parameters may apply.

What happens if I discover another error after filing an SC1040X?

If you find additional errors after filing an SC1040X, you can file another amended return. Ensure that this subsequent amendment accurately reflects all the corrections needed, including those from the original return and any errors discovered afterward. It's important to detail all changes from the original return to avoid processing delays.

Who can I contact if I have questions while filling out the SC1040X?

If you have questions or need assistance while completing the SC1040X, you can contact the South Carolina Department of Revenue directly. They can provide guidance on how to accurately complete the form. Additionally, tax preparation professionals can offer assistance with amending your return and ensuring all information is complete and accurate.

Common mistakes

Filling out the SC1040X form correctly is crucial for residents amending their South Carolina tax returns. However, mistakes can occur during this process. Here are five common errors to avoid:

Incorrect Original Amounts: Taxpayers often enter incorrect figures from the original tax return into Column A. It's important to input the exact numbers as they appeared on your initially filed SC1040 form for accuracy.

Failing to Explain Changes: Another frequent mistake is not providing a detailed explanation for each amendment in Part V. Documenting the reason for every change, along with attaching any necessary supporting documents, is essential for a smooth amendment process.

Omitting Supporting Documents: When changes are made to income, credits, deductions, or tax withholdings, relevant documents such as W-2s, 1099s, or federal adjustments must be attached. Overlooking this requirement can delay processing.

Miscalculating the Net Change: In Column B, you're required to indicate the net increase or decrease for each line being altered. Accurate calculations here are crucial to ensure the changes are correctly reflected in the amended return.

Incorrect Bank Account Information for Direct Deposit: For those opting for the direct deposit method to receive refunds, entering incorrect routing or bank account numbers can result in significant delays or misdirected funds. Double-checking these details is imperative.

Ensuring these mistakes are avoided can lead to a smoother processing of the SC1040X form. Always review your amended return carefully before submission.

Documents used along the form

Filing an amended income tax return can be a necessary step to correct an error or make adjustments to your initially filed return. When amending your South Carolina tax return using Form SC1040X, you might find that several other forms or documents may need to be attached or used concurrently to validate the adjustments made. Let’s explore some of the common documents and forms typically utilized alongside the SC1040X form.

- Form W-2: This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. If you have amendments related to employment income or tax withholding, you may need to attach updated or corrected W-2 forms.

- Form 1099: Various 1099 forms report income from self-employment, interest and dividends, government payments, and other sources. If adjusting income not reported on W-2s, relevant 1099 forms should be included.

- Schedule NR: Nonresidents and part-year residents use this schedule to calculate their South Carolina taxable income based on the portion of income attributable to South Carolina. Adjustments to nonresident income will likely necessitate recalculating and submitting this schedule.

- Form SC1040: The standard South Carolina Individual Income Tax Return form. If your amendment changes items that are also reported on the SC1040, providing a revised SC1040 can help clarify these adjustments.

- Form 1040X: This is the Amended U.S. Individual Income Tax Return. If your amendment to the South Carolina return is due to changes in your federal return, attaching the amended federal return (1040X) is necessary.

- Supporting Documentation: Includes any documents that provide evidence for the changes made on your SC1040X. This could range from additional W-2s or 1099s not previously reported, to documentation supporting changes in deductions or credits.

- Direct Deposit Information: If you're expecting a refund due to the amendment and choose direct deposit, ensure your bank routing and account numbers are ready to be supplied on the SC1040X or accompanying documentation.

While dealing with tax forms can be complex, having access to the right information and ensuring accurate and complete documentation can make the process smoother. The documents listed above are often used in conjunction with the SC1040X to provide clear and comprehensive details about the income, tax, credits, and deductions being amended. If you are unsure about any part of the amendment process, seek professional advice to ensure that your taxes are correctly filed and to mitigate the risk of future complications.

Similar forms

The IRS Form 1040X, "Amended U.S. Individual Income Tax Return," is quite similar to the SC1040X in its purpose and structure. It's used by taxpayers who need to correct or update their initial tax return. Both forms require the taxpayer to detail the original amounts reported, the net change for each item being amended, and the corrected amounts. Like the SC1040X, Form 1040X includes sections for explaining the changes made, adjusting income, deductions, tax liability, and credits, as well as calculating the difference in tax owed or refunded.

The 1045 Form, "Application for Tentative Refund," shares some procedural similarities with the SC1040X, albeit for different circumstances. This form is used to request a quick refund for certain situations, such as net operating loss carrybacks or unused general business credits. It also involves amending previous tax returns but is focused on expedited processing for specific tax relief purposes. Where the SC1040X revises state income tax returns for a variety of reasons, the 1045 targets quick refunds from carryback adjustments at the federal level.

Another comparable document is the IRS Form 843, "Claim for Refund and Request for Abatement." This form is used to request a refund of taxes besides income tax, such as FICA and Medicare, or to request an abatement of interest or penalties. Similar to the SC1040X, Form 843 involves providing details about the original tax assessment and the reason for requesting a change, albeit it covers a broader scope of tax issues beyond amendments to filed income tax returns.

The final similar form is the Form 941-X, "Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund." This document is for employers to correct errors on previously filed Form 941s, the quarterly federal tax return. Like the SC1040X, Form 941-X allows for adjustments to previously reported figures and recalculates the corrected tax liability or refund. It is specifically tailored for correcting payroll taxes and calculating the impact of those corrections.

Dos and Don'ts

When dealing with the SC1040X form, a detailed approach is crucial for ensuring accuracy and compliance. Here is a comprehensive guide divided into what you should and shouldn't do to streamline this process:

What You Should Do:

- Review the instructions provided by the South Carolina Department of Revenue before you start, to understand the requirements.

- Double-check the Social Security Numbers for accuracy to avoid processing delays or issues with your tax records.

- Ensure all information matches the documents you’re amending, such as your federal return and any W-2s or 1099s, to maintain consistency.

- Clearly explain each change made on the form in Part V, providing a detailed reason for the amendment. This clarity helps in faster processing.

- Attach all necessary documentation, such as the federal 1040X if you amended your federal return, or any related schedules that support your changes.

- Round all monetary amounts to the nearest dollar to conform with rounding rules.

- Verify your bank account details carefully if expecting a refund via direct deposit. Accurate routing and account numbers are crucial.

- Sign and date the form. If filing jointly, ensure both spouses sign the amended return to validate it.

- Keep a copy of the amended return and all supporting documents for your records.

- File the amendment within the designated timeframe according to SC law, to ensure eligibility for any potential refund.

What You Shouldn't Do:

- Don't leave any sections incomplete. If a section doesn’t apply, indicate with “N/A” or “0”, as appropriate.

- Avoid using pencil or any ink that can smear or fade, making the document hard to read.

- Never guess on figures or necessary information. Verify all details against your records and supporting documents.

- Do not overlook the nonresident section if it applies to you. Ensure Part IV is completed correctly to avoid state-specific discrepancies.

- Resist the urge to change your filing status on the amendment if the due date of the original return has passed.

- Don’t send the amendment without checking if additional taxes are due. If you owe, include your payment to avoid penalties and interest.

- Avoid filing the amended return electronically if the original was filed on paper without confirming that e-filing amendments are accepted for your tax year.

- Do not include irrelevant or unnecessary documentation. Only attach documents that directly support the changes made.

- Never assume the amendment is processed immediately. Allow sufficient time for processing and check your status periodically.

- Don’t forget to update your address or contact information if it has changed to receive any correspondence or refunds promptly.

Misconceptions

Many taxpayers find the SC1040X form challenging due to prevalent misconceptions. Understanding these inaccuracies is critical to filing an amended South Carolina tax return accurately.

Misconception 1: You can only file an SC1040X form for recent tax years. You actually have three years from the filing date, three years from the due date, or two years from when the tax was paid to file an amended return, allowing for changes to older returns as well.

Misconception 2: If you make a mistake on your original return, the SC1040X is your only remedy. While the SC1040X is designed to amend returns, minor errors might be corrected by the Department of Revenue without the need for this form.

Misconception 3: Amended returns always result in owing more tax. Filing an amended return can lead to either additional tax due or a refund, depending on the nature of the corrections.

Misconcentration 4: Nonresidents cannot use the SC1040X. Nonresidents need to correct their income using a new Schedule NR before completing the nonresident section of the SC1040X, making it perfectly usable for them.

Misconception 5: The SC1040X form is complicated and always requires a tax preparer's assistance. While tax professionals can provide valuable assistance, the form's instructions are designed to guide taxpayers through the amendment process independently.

Misconception 6: You must refile your entire tax return when using the SC1040X. The SC1040X requires only the changes to be documented, not a complete refiling of the entire tax return.

Misconception 7: Corrections of federal returns do not affect state returns. Changes to your federal return can have implications for your state return; thus, an amended federal return often necessitates filing an SC1040X.

Addressing these misconceptions ensures that taxpayers can confidently navigate amending a tax return, securing their financial integrity, and maintaining compliance with tax laws.

Key takeaways

The SC1040X form is designed for individuals to amend previously filed tax returns for the state of South Carolina. Understanding its purpose and how to properly fill it out ensures compliance and rectifies any errors or changes to an individual's tax situation.

- Amended returns must be filed using the SC1040X form for tax years 2018 and earlier. For tax years 2019 and later, amendments are made on the SC1040 form, with the amended return check box marked and Schedule AMD attached.

- Amendments can result from various changes, such as omitted income, incorrect deductions or credits, changes in filing status, or as a result of an audit by the IRS.

- The form should be filled out with the taxpayer's most current information, including name, Social Security Number, and mailing address. This information is crucial for processing the amendment correctly.

- Filing status on the amended return generally matches the filing status on the federal return, and once the original return's due date has passed, filing status changes from joint to separate are not permitted.

- The number of exemptions or dependents from the federal return should be entered on the SC1040X.

- Taxpayers must meticulously fill Columns A, B, and C in Part II of the form to reflect original amounts, adjustments made, and the corrected amounts.

- Documentation supporting changes, such as corrected W-2s or 1099s, must be attached if there are adjustments to income, tax withheld, or credits.

- Nonresidents or part-year residents need to complete Part IV before addressing sections of the form that pertain to income and tax calculations to ensure accuracy.

- If the amendment results in a refund, taxpayers can choose the refund method. Options include direct deposit, which is the fastest way to receive refunds, or receiving a debit card or paper check.

- A balance due on the amended return could incur penalties and/or interest. Taxpayers will be notified of the additional amounts owed.

- All claims for refunds must adhere to specific timing restrictions, including a three-year window from the filing date or the original due date, or two years from the payment date, whichever is later.

- The SC1040X form must be signed and dated by the taxpayer, and if filed jointly, both spouses must sign. Paid preparers should also provide their details in the designated section.

It is imperative for taxpayers to ensure accuracy and completeness when amending returns. The SC1040X form, along with the requisite documentation, provides the South Carolina Department of Revenue with the necessary information to correct and update a taxpayer's record. Taxpayers are encouraged to consult with a tax professional or the Department of Revenue's guidance to avoid mistakes and ensure compliance with state tax laws.

More PDF Templates

South Carolina Corporate Tax Return - Documentation of federal or other state extensions attached is necessary for processing.

Sc Dss Forms - Recertifying for ADAP insurance assistance is simple with the SC ADAP Insurance Recertification form.

What Is Form 8453 - It is crucial for employees in temporary or non-permanent roles considering non-membership in retirement benefits.