Fill Your Sc8736 Template

Understanding the pivotal role of the SC8736 form is essential for individuals and entities within South Carolina looking to navigate the intricate pathway of tax regulations. Specifically tailored for fiduciaries and partnerships, this form serves as a request for an extension of time to file the respective South Carolina tax returns. Mandated by the State of South Carolina Department of Revenue, the form accommodates those who may not be able to meet the original filing deadline, providing a structured approach to seeking additional time. With sections detailing required payments of estimated tax and instructions on computing the amount due with the extension, adherence to these guidelines is crucial to avoid penalties and interest for late payment. It is noteworthy that obtaining an extension to file does not extend the time to pay taxes due, underscoring the importance of estimating and remitting any taxes owed by the original due date to avert potential financial charges. Furthermore, the form emphasizes the necessity of providing accurate taxpayer identification numbers and adheres to privacy laws protecting personal information, ensuring a balance between regulatory compliance and protection of individual rights. Through a detailed breakdown of its components, including who may file, when and how to file, and specific reminders regarding payment and penalties, the SC8736 form emerges as a significant document for those seeking an extension on their South Carolina tax filings.

Document Example

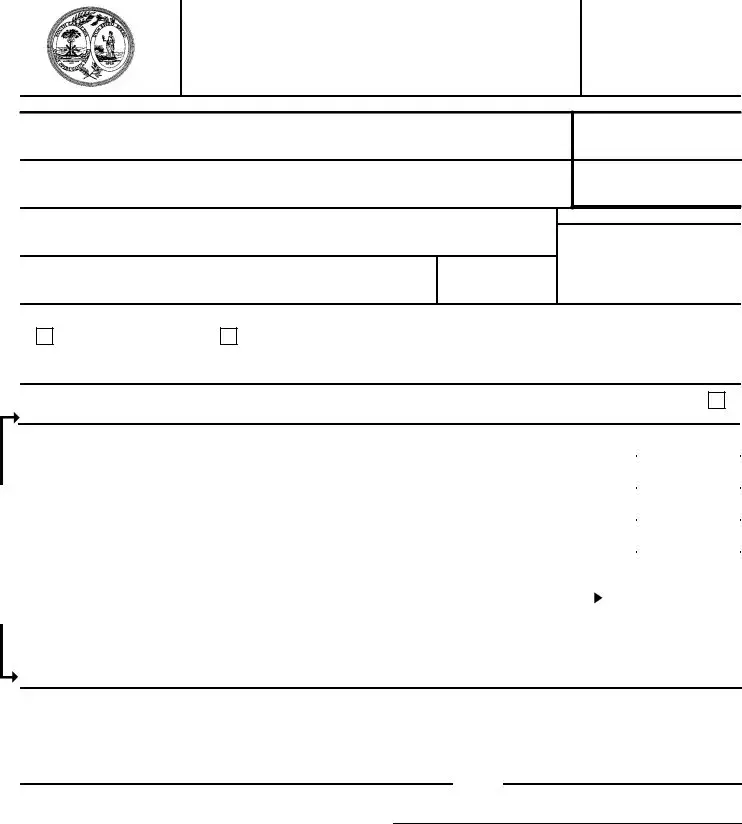

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

REQUEST FOR EXTENSION OF TIME

TO FILE SOUTH CAROLINA RETURN FOR FIDUCIARY AND PARTNERSHIP

SC8736

(Rev. 8/30/05)

3390

2005

Or other taxable year beginning |

, 2005 and ending |

, 2006 |

Name

SC File number, if any

Present home address (number and street, or P. O. Box)

Employer Identification number

City, State and ZIP code

Do not write in this space - OFFICE USE

Area Code Daytime telephone

County code number

This application is a request for extension of time to file the following return:

FIDUCIARY

SC1041

PARTNERSHIP

SC1065

STAPLE PAYMENT HERE

Check this box if this will be your first time filing a return in South Carolina. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART I. |

|

|

|

|

|

|

|

1. |

Total state income tax |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

1. |

$ |

|

|

2. |

Payments on declaration of estimated tax |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 |

$ |

|

|||

3. |

Tax credits |

. . . . |

3 |

$ |

|

||

4. |

Total credits (add lines 2 and 3) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 |

$ |

|

|||

5. |

Balance due (subtract line 4 from line 1). |

BALANCE |

|

|

|

|

|

|

|

|

|

||||

|

Pay in full with this form |

DUE |

|

5 |

|

$ |

|

|

. . |

|

|

||||

Make check or money order payable to :

SC DEPARTMENT OF REVENUE

(Partnerships enter on line 5 the estimated amount required to be withheld on income of nonresident partners)

PART II.

A COPY OF THIS FORM PLUS ANY ADDITIONAL EXTENSION MUST BE ATTACHED TO YOUR FINAL RETURN WHEN FILED.

NOTE: This extension cannot be processed without proper SC file number or EIN.

Date

Signature

Prepared by:

Mail To: SC DEPARTMENT OF REVENUE |

INCOME TAX COLUMBIA SC |

SC8736 |

SC8736 INSTRUCTIONS

A.WHO MAY FILE: This application can be used by the following:

1.a partnership filing an SC1065

2.a fiduciary filing an SC1041

Mark the appropriate box on the front of this form to indicate the type of extension being requested.

If you estimate that your SC income tax return will show a tax balance due, you are required to file a SC extension form and pay all taxes due by the due date of the return (generally April 15). To avoid the failure to pay penalty, you must pay at least 90% of the tax due by this date.

The extension must be properly signed.

To request an extension of time for a partnership, submit this form stating the reason(s) for the extension of time and the number of days. EACH partner must prepare and submit a SC4868 in order to obtain an extension of time for the individual return. NOTE: At the time of the final approval of this form, the Internal Revenue Service (IRS) was considering the approval of a single six month extension to October 15. If the IRS approves this extension, you will have the same amount of time to file your SC return. No additional extension would be required.

REMINDERS:

See SC1065 and instructions for information on the requirement by partnerships to pay withholding tax on South Carolina taxable income of nonresident partners.

Refunds cannot be issued from the SC1065. An overpayment must be claimed and refunded at the partner level.

B.WHEN TO FILE: File this application ON OR BEFORE April 15th, or before the original due date of your fiscal year return. If the due date for filing your return falls on a Saturday, Sunday, or legal holiday, substitute the next regular working day.

C.HOW AND WHERE TO FILE: File the original SC8736 with the SC Department of Revenue and pay the amount on line 5, Part I. Attach a copy to the back of your return when it is filed. Retain a copy of this form for your records. Your tax return may be filed any time prior to the expiration of the extension.

D.HOW TO CLAIM CREDIT FOR PAYMENT MADE WITH THIS APPLICATION ON YOUR RETURN: Show the amount paid with this application on the appropriate line of your tax return. Correct identification numbers in the spaces provided on all forms are very important!

E.COMPUTE AMOUNT DUE WITH EXTENSION:

LINE 1. Enter the amount of income tax you expect to owe for the current tax year (the amount you expect to enter on the tax return, when you file). Be sure to use good judgement in estimating the amount you owe. To avoid the failure to pay penalty, you must pay at least 90% of the tax due by April 15, and pay the balance due when you file your return within the extended time period.

LINE 5. An extension of time to file your tax return will NOT extend the time to PAY your income tax. Therefore, you must PAY IN FULL WITH THIS FORM the amount of income tax shown on line 5, Part I, page 1. Make your check payable to the "SC Department of Revenue". Write your file number and/or EIN and "2005 SC8736" on the payment.

Staple payment to the front of this form in the indicated area.

F. INTEREST AND PENALTY FOR FAILURE TO PAY TAX: The extension of time to file your South Carolina tax return granted by this application DOES NOT extend the time for payment of tax. Any unpaid portion of the final tax due will bear interest at the prevailing federal rates.This amount is computed from the original due date of the tax return to the date of payment. In addition to the interest, a penalty at the rate of 1/2% per month to maximum of 25% must be added when the amount remitted with the extension fails to reflect at least 90% of the tax due by April 15. The penalty will be imposed on the difference between the amount remitted with the extension and the tax to be paid for the period.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form, if you are an individual. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

Form Properties

| Fact | Detail |

|---|---|

| Form Number | SC8736 |

| Revision Date | August 30, 2005 |

| Applicable For | Fiduciary (SC1041) and Partnership (SC1065) Returns |

| Purpose | Request for Extension of Time to File South Carolina Return |

| When to File | On or before April 15 or the original due date of your fiscal year return |

| Where to File | Mail to SC Department of Revenue, Income Tax, Columbia SC 29214-0013 |

| Payment Requirement | Pay in full the amount shown on line 5, Part I with this form |

| Governing Law | South Carolina Regulation 117-201 and Family Privacy Protection Act |

Guide to Writing Sc8736

Filling out the SC8736 form, a document required by the South Carolina Department of Revenue, necessitates careful attention to detail and precision. This procedure is integral for individuals who wish to obtain an extension of time to file their South Carolina return for fiduciary and partnership taxes. The clear and accurate completion of this form is crucial to ensure compliance with local tax laws and avoid potential penalties associated with late submissions. The steps outlined below provide guidance through the process of completing the form accurately, ensuring that the request for an extension is properly communicated to the state’s tax department.

- Begin by entering the taxable year at the top of the form, including both the start and end dates.

- In the "Name" field, input the full legal name of the fiduciary or partnership requesting the extension.

- Fill in the "SC File number" if previously assigned, or leave blank if filing for the first time.

- Provide the present home address or principal business location, including the number, street, or P.O. Box, city, state, and ZIP code.

- Enter the Employer Identification Number (EIN) in the designated area.

- Include a daytime telephone number with the area code for potential contact purposes.

- Indicate the county code number if known.

- Check the appropriate box to specify the type of return for which the extension is being requested (FIDUCIARY SC1041 or PARTNERSHIP SC1065).

- If this is your first time filing a return in South Carolina, make sure to check the indicated box.

- Under PART I, calculate the total state income tax expected to be owed and enter this amount on line 1.

- Report any payments made on the declaration of estimated tax and enter this figure on line 2.

- List any applicable tax credits on line 3.

- Add lines 2 and 3 together to compute the total credits, and record this sum on line 4.

- Subtract the total credits (line 4) from the total state income tax (line 1) to find the balance due, and enter this amount on line 5. Pay this balance in full when submitting the form.

- Sign and date the form at the bottom, indicating your acknowledgment and request for the extension. If the form was prepared by someone other than the filer, ensure their information is included as well.

- Mail the completed form and any payment due to: SC DEPARTMENT OF REVENUE, INCOME TAX, COLUMBIA SC 29214-0013, with the check or money order made payable to the "SC Department of Revenue." Write your file number and/or EIN and "SC8736" on the payment. Attach payment to the front of this form as indicated.

Once the SC8736 form is duly completed and submitted, taxpayers must await acknowledgment of the extension from the Department of Revenue. It’s critical to note that this extension grants additional time to file the required tax documents but does not extend the deadline for tax payment due. Therefore, ensuring the estimated tax liability is paid in full with this form is essential to avoid interest and late payment penalties. Importantly, do retain a copy of the form and any correspondence for your records.

Understanding Sc8736

What is the purpose of the SC8736 form?

The SC8736 form is used to request an extension of time to file a South Carolina return for fiduciary and partnership taxes. It allows entities such as partnerships and fiduciaries to extend their filing deadline, ensuring they have enough time to accurately complete their tax returns.

Who needs to file an SC8736 form?

Partnerships that need to file an SC1065 and fiduciaries required to file an SC1041 in South Carolina should use the SC8736 form to request an extension of time to file these specific returns. It is important that the correct box is marked on the form to indicate which type of extension is being requested.

How can I avoid penalties when filing for an extension?

To avoid the failure-to-pay penalty, you must pay at least 90% of your expected tax due by the original due date of your return, typically April 15. The balance must then be paid with the filed return within the extended time period to fully avoid penalties.

What is the deadline for filing the SC8736 form?

This application must be filed on or before April 15th, or before the original due date of your fiscal year return. If the due date falls on a Saturday, Sunday, or legal holiday, you should file by the next regular working day.

Where should the SC8736 form be filed?

The original SC8736 form should be filed with the SC Department of Revenue. Additionally, a copy of the form must be attached to the back of your return when it is filed. It’s also recommended to keep a copy for your records.

How do I calculate the amount due with my extension?

Enter the expected income tax you owe for the current tax year on line 1. This should be a good faith estimate of the tax you expect to owe. The full amount calculated on line 5, which represents the balance due after credits, must be paid in full with the form.

How should payment be made for the SC8736 form?

Make your check or money order payable to the "SC Department of Revenue" and staple it to the front of the SC8736 form in the indicated area. Be sure to include your file number and/or EIN and "2005 SC8736" on the payment for proper identification.

Is an extension of time to file also an extension of time to pay?

No, an extension to file your South Carolina tax return does not extend the time to pay any tax due. You are required to estimate and pay the full amount of your tax liability with your extension request to avoid penalties and interest.

What are the consequences of failing to pay the tax due with the extension?

If the full amount of tax due is not paid with the extension, the unpaid portion will accrue interest at the federal rate from the original due date of the tax return to the payment date. Additionally, a failure-to-pay penalty of 1/2% per month, up to a maximum of 25%, may be imposed.

Is personal information required on the SC8736 form protected?

Yes, personal information such as your social security number is required for identification purposes and is protected by law from unauthorized disclosure under the Family Privacy Protection Act. This act limits the collection of personal information and restricts its use for commercial solicitation purposes.

Common mistakes

Filling out the SC8736 form, which is the Request for Extension of Time to File South Carolina Return for Fiduciary and Partnership, requires careful attention to detail. Mistakes can lead to processing delays or incorrect tax calculations. Here are eight common mistakes that individuals often make when completing this form:

- Incorrect Identification Numbers: Not providing the correct South Carolina File Number or Employer Identification Number (EIN) can prevent the form from being processed. These numbers are crucial for the Department of Revenue to identify the taxpayer.

- Failure to Sign: Forgetting to sign the form at the bottom is a common oversight. A signature is necessary to validate the form, and an extension request will not be processed without it.

- Incorrect Tax Amounts: Incorrectly estimating the amount of state income tax due, or not accurately calculating payments on declaration of estimated tax, can result in penalties and interest charges.

- Not Stapling Payment: If there is a payment due with the form, failing to staple the payment in the designated area can lead to misplacement and processing delays.

- Not Checking the Box for First-time Filers: First-time filers need to check the specific box indicating their status. Neglecting this detail can cause confusion and could potentially lead to the mismanagement of the taxpayer's records.

- Incorrect Filing Year: Not specifying or mistaking the taxable year for which the extension is being requested. It's critical to ensure that the form covers the correct fiscal period to avoid mismatched records.

- Missing Attachments: Not attaching a copy of the SC8736 form to the final return when filed. This omission can affect the processing of the tax return.

- Ignoring the Due Date: Filing the extension request after the original due date, generally April 15th, can result in penalties despite the extension. The form must be filed on or before the due date to avoid late payment penalties.

Additionally, there are a few steps that individuals can take to ensure that their extension request is properly processed:

- Double-check all entered information for accuracy.

- Ensure that any payment made with the form is accurately calculated and properly attached.

- Retain a copy of the SC8736 form and any corresponding payment records for personal records.

- Be mindful of the distinction between the extension to file and the extension to pay, recognizing that taxes owed are due by the prescribed date regardless of the filing extension.

By avoiding these common mistakes and following the prescribed steps for submission, taxpayers can ensure a smoother processing of their extension requests and avoid unnecessary complications with their tax obligations in South Carolina.

Documents used along the form

When preparing to submit the SC8736 form, a Request for Extension of Time to File South Carolina Return for Fiduciary and Partnership, there are various other forms and documents that might need to be considered or included to ensure a comprehensive approach to tax filing and compliance. Each of these documents serves a unique purpose, contributing essential information required for accurate and timely submission.

- SC1065 - Partnership Income Tax Return: This form is for partnerships to report income, deductions, gains, losses, etc., that affect the partners' share of the partnership's income. It's vital alongside the SC8736 for partnerships seeking an extension.

- SC1041 - Fiduciary Income Tax Return: Required for estates or trusts to report income, deductions, and any taxes due. If a fiduciary requests an extension via SC8736, this return will eventually need to be filed.

- SC4868 - Application for Automatic Extension of Time to File Individual Income Tax Return: Each partner in a partnership may need to file this form individually if an extension is necessary for their personal income tax filings.

- SC1040 - Individual Income Tax Return: Individuals in South Carolina use this form to file their income taxes. It may be relevant for partners in a partnership after filing SC4865 or if a fiduciary has individual tax obligations.

- SC W-3 - The South Carolina Withholding Tax Reconciliation Form: Required for reporting total state income tax withheld from employees' wages. Partnerships and fiduciaries with employees will need this form for accurate tax reporting.

- SC Schedule K-1 - Provides detailed information about the distribution of income, deductions, and credits to each partner in a partnership. This form is essential for the partners to accurately report their share of the partnership's income on their personal tax returns.

- 1099 Forms - These forms report various types of income other than wages, salaries, and tips. Depending on the nature of the income received by the partnership or fiduciary entity, one or several 1099 forms may need to be filed.

- 8865 Form - Return of U.S. Persons With Respect to Certain Foreign Partnerships: If the partnership has foreign transactions or foreign partners, this form is crucial to comply with IRS regulations and must be addressed when requesting extensions.

Understanding the purpose and requirements of each of these forms can significantly simplify the process of requesting an extension through the SC8736 form. Moreover, it ensures that all related tax obligations are appropriately managed, helping to prevent possible penalties or delays. Coordination among these documents ensures a smooth and compliant tax filing process, protecting the interests of both the fiduciary entities and their constituents.

Similar forms

The SC4868 form, also known as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, shares similarities with the SC8736 form. Both forms serve the purpose of requesting additional time to file tax returns beyond the original due date. While the SC4868 pertains to individual income tax returns at the federal level, the SC8736 is specific to South Carolina and addresses fiduciary and partnership income tax returns. Each form requires the taxpayer to estimate their tax liability and make any necessary payment to avoid penalties.

The SC1120-CDP is another form sharing similarities with the SC8736, specifically designed for South Carolina corporations requesting an extension of time to file their corporate tax returns. Like the SC8736, it helps taxpayers avoid penalties for late filing, provided they estimate their tax liability and make any required payments. Both forms are geared toward different taxpayer classes but operate under the same principle of granting more time for tax preparation and filing.

The Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, at the federal level, functions similarly to the SC8736. It is used by businesses, including partnerships and corporations, to request additional time to file their tax returns. Both forms require the taxpayer to provide an estimate of the tax owed and include a payment if necessary to minimize penalties, emphasizing the importance of timely financial responsibility.

The Form 8868, Application for Extension of Time To File an Exempt Organization Return, is akin to the SC8736, as it is designed for non-profit organizations seeking more time to file their federal tax returns. While the 8868 pertains to exempt organizations and the SC8736 to fiduciaries and partnerships, both underscore the necessity of requesting an extension to ensure compliance and accuracy in tax reporting and payment.

The SC1041, South Carolina Fiduciary Income Tax Return, is directly associated with the SC8736 in that the latter form can serve as a request for an extension to file the SC1041. Both documents are integral for fiduciaries in South Carolina, enabling them to manage and fulfill their tax obligations effectively. The forms complement each other, with SC8736 facilitating a smoother, penalty-free filing process for the fiduciary tax returns.

The SC1065, South Carolina Partnership Return of Income, relates closely to the SC8736 form, as partnerships use the SC8736 to request more time to file their SC1065 returns. The SC1065 form outlines the income, gains, losses, deductions, and credits of the partnership, while SC8736 allows for a delay in filing, ensuring partnerships have adequate time to accurately report their financial activities.

The Form 1041, U.S. Income Tax Return for Estates and Trusts, serves a similar purpose at the federal level to what the SC8736 does for South Carolina fiduciaries. Form 1041 is used by fiduciaries to report the income, deductions, and other financial information of estates and trusts. When extensions are needed, forms akin to SC8736 at the federal level are utilized, underscoring the extension's pivotal role in tax administration.

The Form 1065, U.S. Return of Partnership Income, at the federal level, also parallels the SC1065 and, by extension, the SC8736's function for partnerships. This form facilitates the reporting of income and losses of partnerships in the United States. Requests for more filing time via forms resembling SC8736 highlight the importance of thorough and accurate financial reporting within partnerships.

The IT-370-PF, Application for Automatic Extension of Time to File for Partnerships and Fiduciaries, specific to New York State, resembles the SC8736 in purpose and use. Both forms extend the filing deadline for partnerships and fiduciaries, acknowledging the complex nature of these entities' tax obligations. The forms illustrate a common need across different jurisdictions for additional time to fulfill tax reporting duties accurately.

Dos and Don'ts

When it comes to handling the SC8736 form for requesting an extension of time to file South Carolina returns for fiduciary and partnership, individuals and businesses should proceed with caution to ensure the process is executed correctly and efficiently. Below are key actions to take and to avoid:

- Do ensure that the form is filled out completely, including all required identifiers such as the SC file number or Employer Identification Number (EIN).

- Do not neglect to sign the form. An unsigned form can lead to processing delays or outright rejection of the request for extension.

- Do calculate the estimated tax due carefully and make the payment along with the submission of the form to avoid penalties and interest.

- Do not wait until the last minute to file. Submit the SC8736 form by the due date, which is typically April 15th, or before the original due date of the fiscal year return to avoid late penalties.

- Do remember to pay at least 90% of the estimated tax due by the original due date to avoid a failure-to-pay penalty, as an extension to file is not an extension to pay.

- Do not overlook the payment instructions. Make checks payable to the "SC Department of Revenue" and clearly indicate the payer's file number and/or EIN along with "2005 SC8739" on the payment.

- Do attach a copy of the completed form to your final tax return upon submission.

- Do not ignore the requirement to attach any additional documentation that supports the request for extension if applicable.

- Do keep a copy of the form and any payment records for your files as proof of compliance and for future reference.

Failure to adhere to these guidelines can lead to unnecessary stress, and financial repercussions, including penalties and interest on taxes owed. It is essential to approach tax obligations with attention to detail and a sense of responsibility to ensure compliance with state requirements.

Misconceptions

Understanding the intricacies of tax forms can be daunting, and the South Carolina SC8736 form is no exception. This form, used to request an extension of time to file a fiduciary or partnership return in South Carolina, is often surrounded by misconceptions. Here are five common ones, debunked to help clarify the process:

- Filing an Extension Extends the Payment Deadline: Many believe that requesting an extension using the SC8736 form also extends the time to pay taxes owed. However, this form only extends the filing deadline. Taxes owed are still due by the original deadline, typically April 15th, to avoid penalties and interest.

- Automatic Approval: Another misconception is that submitting an SC8736 automatically grants an extension. While the process is straightforward, the extension must be approved, and it is contingent upon the form being correctly filled out and submitted with any taxes due.

- No Payment Required with Form Submission: Some think that if they can't pay their taxes, they shouldn't submit a payment with their extension request. However, to avoid penalties and interest, taxpayers should pay as much as possible with the SC8736. The form explicitly asks for the balance due to be paid in full when filed.

- Extensions Apply to Both Fiduciary and Partnership Returns Equally: It's commonly misunderstood that the SC8736 treats fiduciary and partnership returns similarly beyond just providing an extension. In reality, specific requirements and implications may differ between fiduciary (SC1041) and partnership (SC1065) forms, particularly regarding payments, withholdings, and penalties.

- The Need for Individual Extensions for Partners: There's a belief that if a partnership files an extension with the SC8736, it also covers the individual returns of the partners. However, this is not the case. Partners must individually request extensions for their personal returns if needed.

Correctly navigating the SC8736 form and understanding its purpose are crucial steps in ensuring compliance with South Carolina's tax laws, thus avoiding unnecessary fines or complications. Taxpayers should consider consulting with a tax professional to ensure they understand all requirements and deadlines associated with their filing status.

Key takeaways

When you're navigating the intricacies of filing tax returns in South Carolina, particularly for fiduciaries and partnerships, understanding the SC8736 form is essential. This form, known as the "Request for Extension of Time to File South Carolina Return for Fiduciary and Partnership," serves a vital role in tax administration for these entities. Here are four key takeaways to keep in mind:

- Who Should File: The SC8736 is specifically designed for partnerships and fiduciaries needing more time to prepare their South Carolina tax returns. If you're involved in a partnership that files an SC1065 or acting as a fiduciary required to file an SC1041, this form is relevant to your tax filing process. Remember to mark the correct box on the form to indicate the specific extension you're requesting.

- Deadline and Timing: Timing is crucial; make sure to file this application by April 15th or by the due date of the original fiscal year return to avoid penalties. If you find the due date falls on a weekend or a legal holiday, don't worry. You can submit the form on the next regular working day. An extension provides additional time to file your return but does not extend the time to pay any taxes due.

- Filing Process and Payment: You must file the original form with the South Carolina Department of Revenue and include the payment for the balance due shown in Part I, line 5, of the form. A noteworthy point is that an accurate estimation of the tax due is essential because it affects the possibility of penalties for underpayment. After filing, attach a copy of this form to your final return and keep a copy for your records.

- Avoiding Penalties: It's important to underline that the extension to file does not extend the time for tax payment. To sidestep penalties, at least 90% of the expected tax due should be paid by the original due date, April 15th. Failure to meet this threshold can result in penalties and interest accumulating from the initial due date until the tax is fully paid. Ensuring all your ducks are in a row, by accurately completing the form and making necessary payments, can save you a lot of headaches down the road.

Understanding and precisely using the SC8736 can significantly ease the stress of tax season for partnerships and fiduciaries in South Carolina. With careful attention to deadlines, meticulous preparation, and compliance with payment requirements, you can navigate this process smoothly and efficiently.

More PDF Templates

Beer and Wine License Cost - By requiring personal contact information, the form facilitates open channels of communication between the applicant and the Department.

Dhec Forms - There's a dedicated disclaimer about the illegality of making a false application for vital records, underlining the seriousness of the process.

Sc Fishing License Cost - A provision is made for applicants who may have a different mailing address from their home address, ensuring all correspondence reaches them.