Fill Your South Carolina 1040Es Template

The South Carolina 1040ES form serves as the declaration of estimated tax for individuals, a document designed to assist taxpayers in managing their estimated income tax payments throughout the fiscal year. This form is primarily intended for individuals who anticipate owing $1,000 or more in taxes when their income tax return is filed. It caters to various residents of South Carolina, including full-year residents, part-year residents, and nonresidents earning taxable income within the state. Taxpayers are typically required to make quarterly payments, with specific due dates throughout the year; these are April 15, June 16, September 15, and January 15 of the following year. However, special rules apply for certain groups, such as farmers and commercial fishermen, who may have different payment schedules due to the nature of their income. Additionally, the form provides guidelines for adjusting withholding exemptions via employers or for those receiving civil service retirement incomes, aiming to ease the accurate calculation and payment of estimated taxes. Joint filers should note that specific conditions might necessitate separate declarations. Importantly, the form underlines the necessity to amend declarations if significant income changes occur, and outlines the repercussions of failure to file or pay the estimated tax, including potential penalties. For those navigating these financial responsibilities, the South Carolina 1040ES form and accompanying instructions are invaluable resources for ensuring compliance with state tax regulations.

Document Example

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE www.sctax.org

INSTRUCTIONS AND FORMS FOR

2003

DECLARATION OF ESTIMATED TAX

FOR INDIVIDUALS

File and Pay

FORM SC1040ES

STATE OF SOUTH CAROLINA

INDIVIDUAL DECLARATION OF ESTIMATED TAX

INSTRUCTION AND WORKSHEET

The enclosed declaration

A WHO MUST FILE A DECLARATION

Every individual must file a declaration of estimated tax for 2003 if the expected total amount of tax owed when the income tax return is filed will be $1000.00 or more. This includes all individuals residing in the state, also nonresidents and

Exceptions for filing a declaration are:

(1)Farmers and Commercial Fishermen whose gross income from farming or fishing for 2002 or 2003 is at least

(2)Any Individual who was a resident of South Carolina throughout the preceding taxable year, had no South Carolina tax liability for the prior year, and whose prior year tax return was (or would have been, had the individual been required to file) for a full 12 months;

(3)Any Individual who was not a resident of South Carolina throughout the preceding taxable year, had no South Carolina tax liability for the prior year, and whose prior year tax return was (or would have been, had the individual been required to file) for a full 12 months;

(4)Any nonresident taxpayer doing business in South Carolina on a contract basis when the contract exceeds ten thousand dollars ($10,000) and the tax is withheld at the rate of two percent (2%) from each contract payment.

NOTE: You may be able to avoid making estimated tax payments by asking your employer to withhold more state tax from your earnings, if applicable. To increase your state withholding, file a new withholding exemption certificate. Civil service retirees may contact the US Office of Personnel Management at

B WHEN TO FILE YOUR ESTIMATED TAX

(2) Fiscal Year taxpayers must file their declaration of estimated tax vouchers on the 15th day of the 4th, 6th, and 9th months of the fiscal year and the first month of the following fiscal year.

C PAYMENT OF ESTIMATED TAX

Pay your estimated tax in equal amounts on the required filing dates attached to the corresponding voucher; however, you may pay all of your estimated tax on April 15, when the first installment is due. Instead of making your last payment of estimated tax on January 15 (Voucher Number 4), you may file your completed income tax return by January 31 and pay in full the balance of all income tax owed. If there is any overpayment shown on the income tax return filed, the overpayment may be transferred to your estimated tax account for the next year. The amount to be transferred must be entered on the income tax return. The declaration voucher does not have to be attached to the return for the transfer to be made.

D JOINT VS. SINGLE DECLARATION

A husband and wife who are living together may file a joint declaration; however, there are exceptions that require a single or separate declaration. These exceptions are: (1) married taxpayers with different taxable years and (2) married taxpayers who wish to retain their own identity by using different last names.

NOTE: Married taxpayers who file joint SC1040ES vouchers but file separately (or vice versa) when filing Form SC1040 may not receive proper credit for their estimated payments thus generating a deficiency or other notice. Should this occur, contact with the South Carolina Department of Revenue will be required to clarify the matter.

E AMENDED DECLARATION

Your declaration must be amended if you find that the estimated tax is substantially increased or decreased as a result of (1) a change in income, (2) a change in exemptions or (3) a change in the income tax withholding. The amended declaration should be filed on or before the next filing date that is June 16, September 15, or January 15. A special form for amending your declaration will not be needed. Therefore you must use the regular declaration voucher for the filing period.

F PENALTY FOR FAILURE TO FILE AND PAY ESTIMATED TAX

You may be charged a penalty for not paying enough estimated tax, or for not making the payments on time in the required amount. The penalty does not apply if each required payment is timely and the total tax paid is at least 90% of the total tax due. No penalty will be due for underpayments attributable to personal service income earned in another state on which income tax withholding due to the other state was withheld. Most taxpayers filing a declaration may also avoid penalty by paying 100% of the tax shown to be due on the return filed for the preceding taxable year. You must have filed a South Carolina return for the preceding tax year and it must have been for a full

G HOW TO USE THE

The preprinted

(1)If you do not have a preprinted

(2)Enter the amount shown on line 11 of the worksheet on the Amount of Payment line. If no payment amount is due, no payment voucher needs to be filed.

(3)Tear off at the perforation.

(4)Attach your check or money order, made payable to the South Carolina Department of Revenue, to the

Mail the

Cut Here

STATE OF SOUTH CAROLINA |

2003 |

DEPARTMENT OF REVENUE |

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 8/20/02)

3080

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

Payment Voucher Number |

1 |

||

|

|

|||

Your Social Security Number |

Spouse's Social Security Number (if joint) |

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint) |

|

ENTER PAYMENT AMOUNT |

|

|

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

INSTRUCTIONS TO FOLLOW WHEN AMENDING YOUR DECLARATION

1.Use the Estimated Tax Worksheet on the reverse side as your guide to determine the Amended tax due using the corrected amounts of income, deductions and exemptions from your federal information.

2.Fill out the Amended Declaration Schedule below to determine the amount to be paid.

3.Refer to the

4.Tear off

|

2003 AMENDED DECLARATION SCHEDULE |

||

|

(Use if the estimated tax changes after you file your declaration.) |

||

|

|

|

|

1. |

Amended estimated tax enter here |

|

|

2. |

Less (A) Amount of 2002 overpayment elected for credit to 2003 |

|

|

|

(B) Estimated tax payments to date |

|

|

|

(C) Total of lines 2(A) and (B) |

|

|

3. |

. . . . . . . . . . . .Unpaid balance (subtract line 2(C) from line 1) |

|

|

4. |

Amount to be paid (line 3 divided by number of remaining filing dates) Enter here and on |

|

|

|

Payment |

|

|

|

|

|

|

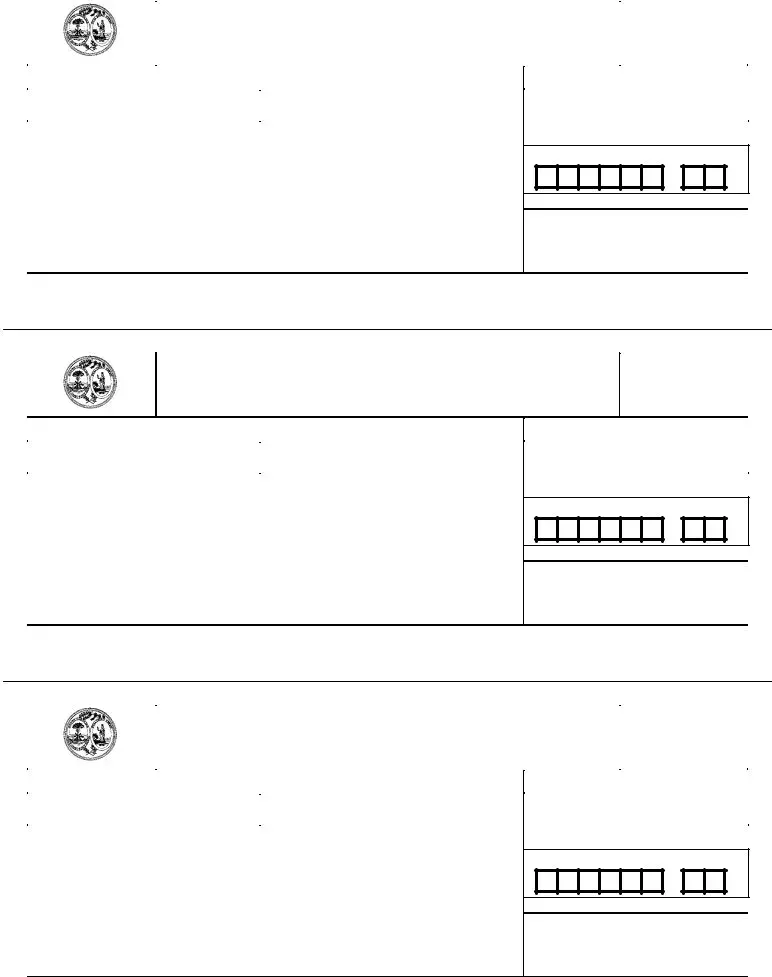

2003 Tax Computation Schedule for South Carolina Residents and Nonresidents

TAX COMPUTATION SCHEDULE |

|

|

|

Example of computation for Tax Computation Schedule |

||

|

|

|

|

|

||

If the amount on line 3 of worksheet is: |

Compute the tax as follows: |

|

|

South Carolina income subject to tax on line 3 of worksheet is $15,240. |

||

|

|

|

|

|

||

|

BUT NOT |

|

|

|

The tax is calculated as follows: |

|

|

|

|

|

|

|

|

OVER |

|

|

$15,240.00 income from line 3, of worksheet |

|||

$0 |

$2,460 |

2.5% Times the amount $ |

0 |

|

||

|

X .07 percent from tax computation schedule |

|||||

2,460 |

4,920 |

3% Times the amount less $ |

12 |

|

||

|

1,066.80 |

|

||||

4,920 |

7,380 |

4% Times the amount less $ |

62 |

|

||

|

||||||

7,380 |

9,840 |

5% Times the amount less $ 135 |

|

|||

|

|

|

||||

|

$ 709.08 rounded to $710.00 |

|||||

9,840 |

12,300 |

6% Times the amount less $ 234 |

|

|||

|

|

|

||||

12,300+ |

or more |

7% Times the amount less $ 357 |

|

$710.00 is the amount of tax to be entered on line 4 of worksheet |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

2003 |

SC1040ES |

||

|

|

DEPARTMENT OF REVENUE |

(Rev. 8/20/02) |

|||

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

|

|

3080 |

|

|

|

|

|

|

|

|

|

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

|

Payment Voucher Number 2 |

||||

|

|

|

|

|||

Your Social Security Number |

|

Spouse's Social Security Number (if joint) |

|

Calendar year |

||

|

|

|

|

|||

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint)

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

STATE OF SOUTH CAROLINA |

2003 |

DEPARTMENT OF REVENUE |

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 8/20/02)

3080

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

Payment Voucher Number |

3 |

||

|

|

|||

Your Social Security Number |

Spouse's Social Security Number (if joint) |

Calendar year |

||

|

|

|||

|

|

|

|

|

Name and Address (include spouse's name if joint) |

|

|

|

|

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

|

|

STATE OF SOUTH CAROLINA |

2003 |

SC1040ES |

||

|

|

DEPARTMENT OF REVENUE |

(Rev. 8/20/02) |

|||

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

|

|

3080 |

|

|

|

|

|

|

|

|

|

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

|

Payment Voucher Number 4 |

||||

|

|

|

|

|||

Your Social Security Number |

|

Spouse's Social Security Number (if joint) |

|

Calendar year |

||

|

|

|

|

|||

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint)

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

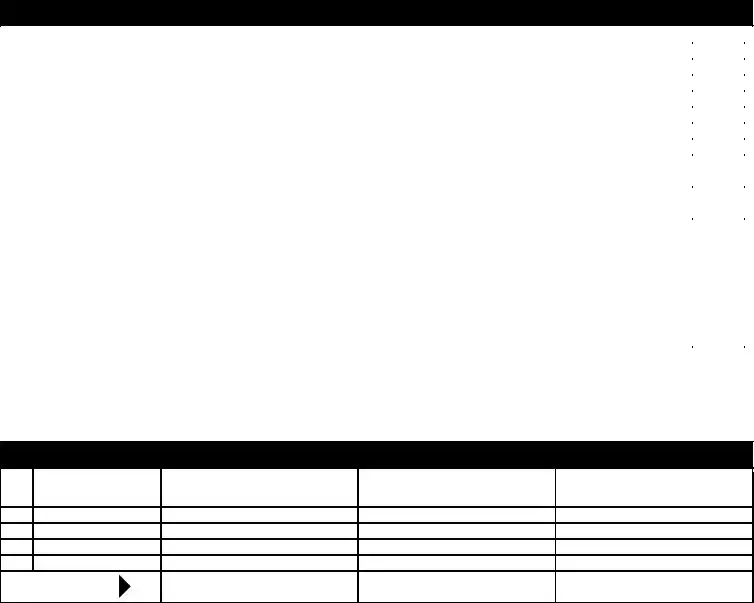

WORKSHEET AND RECORD

OF ESTIMATED TAX PAYMENT

HOW TO COMPUTE YOUR ESTIMATED TAX (Nonresident - see special instructions below.)

Below is your Estimated Tax Worksheet with the tax computation schedule for computing estimated tax. Use your 2002 income tax return as a guide for figuring the estimated tax. See instruction F for penalties.

2003 ESTIMATED TAX WORKSHEET

1. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter amount of your federal taxable income from the 2003 Federal 1040ES, line 5 |

1. |

$ |

|

|

||

|

|

||||||

2. |

Allowable State Adjustments (plus or minus) . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

2. |

$ |

|

|

|

|

|

|

|||||

3. |

This is your South Carolina taxable income . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

3. |

$ |

|

|

|

|

|

|

|||||

4. |

Tax (Figure the tax on line 3 by using the Tax Computation Schedule in these instructions.) |

4. |

$ |

|

|

||

|

|

||||||

5. |

Enter any additional tax (SC4972) . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

5. |

$ |

|

|

|

|

|

|

|

||||

6. |

Add lines 4 and 5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

6. |

$ |

|

|

|

|

|

|

|

||||

7. |

Credits (Child and Dependent Care credit, Tax credit to other states, Two Wage Earner credit, Water Resources, etc) . . . . |

7. |

$ |

|

|

||

|

|

||||||

8. |

Subtract line 7 from line 6 |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

8. |

$ |

|

|

|

|

|

|

||||

9. |

State income tax withheld and estimated to be withheld (including income tax withholding on pension, annuities, etc.) |

|

|

|

|

||

|

during the entire year 2003 |

9. |

$ |

|

|

||

|

|

|

|||||

10. |

Balance estimated Tax (Subtract line 9 from line 8.) If $1000.00 or more, complete and file the |

|

|

|

|||

|

your payment; if less, no payment is required at this time |

10. |

$ |

|

|

||

|

|

|

|||||

|

Caution: You are required to prepay at least 90% of your tax liability each year. If you prepay less than 90% of your |

|

|

|

|

||

|

actual tax liability, you may be subject to a penalty. See Section F of the instructions for penalty information. |

|

|

|

|

||

|

If you are unsure of your estimate, you may want to pay more than 90% of the amount you have estimated. |

|

|

|

|

||

11. |

If the first payment you are required to file is: |

|

|

|

|

|

|

|

Due April 15, 2003, enter 1/4 |

} |

of line 10 (less any 2002 |

|

|

|

|

|

Due June 16, 2003, enter 1/2 |

overpayment applied to 2003 |

|

|

|

|

|

|

Due September 15, 2003,enter 3/4 |

estimated tax). Enter here and |

|

|

|

|

|

|

Due January 15, 2004,enter amount |

on your |

11. $ |

|

|

||

|

|

|

|||||

|

|

|

|

|

|

|

|

RECORD OF ESTIMATED TAX PAYMENT

|

|

|

(C) 2002 |

(D) TOTAL PAID |

NO. |

(A) DATE |

(B) AMOUNT |

OVERPAYMENT |

AND CREDITED |

|

|

|

CREDIT APPLIED |

ADD (B) and (C) |

1.

2.

3.

4.

TOTAL . . . . . . . .

NONRESIDENT - SPECIAL INSTRUCTIONS

Use the 2002 Form SC1040 and Schedule NR as a basis for determining the modified South Carolina taxable income subject to an estimated tax. Enter the modified South Carolina taxable income on line 3 of the above worksheet. Determine the amount of tax using the 2003 tax computation schedule. Enter the tax on line 4 of above worksheet. Complete lines 5 through 11 of above worksheet as instructed.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

Form Properties

| Fact | Detail |

|---|---|

| Purpose | The SC1040ES form is used for the declaration of estimated tax for individuals in South Carolina. |

| Who Must File | Individuals expecting to owe $1000.00 or more in taxes, including residents, nonresidents, and part-year residents with South Carolina taxable income. |

| Payment Schedule | Estimated tax payments are due on April 15, June 16, September 15 of the tax year, and January 15 of the following year. |

| Exceptions for Farmers and Fishermen | Farmers and commercial fishermen have the option to pay all estimated tax by January 15, or file their tax return and pay in full by March 1 without quarterly installments. |

| Penalty for Failure to File and Pay | A penalty may be applied if enough estimated tax isn’t paid or payments are late, unless 90% of the tax due is paid or 100% of the prior year's tax is paid, and increased to 110% for those with a high adjusted gross income. |

| Joint vs. Single Declaration | Married individuals living together may file a joint declaration, with exceptions such as different taxable years or if wishing to retain their own identity by using different last names. |

Guide to Writing South Carolina 1040Es

Filing the South Carolina 1040ES form is a process that requires attention to detail but can be managed efficiently with clear guidance. This procedure is necessary for individuals who anticipate owing $1,000 or more in taxes for the year. It's an important step towards fulfilling your tax obligations and avoiding possible penalties for underpayment. Whether you're a seasoned taxpayer or new to the process, following these steps will help ensure that your estimated tax payments are calculated correctly and submitted on time.

- Start by gathering your previous year's tax return, current year's income estimates, deductions, and any credits you anticipate claiming. This information will help you accurately complete the worksheet.

- Review the "WHO MUST FILE A DECLARATION" section to confirm if you're required to file this form based on your expected South Carolina taxable income and residency status.

- Determine the required filing dates for your estimated tax payments. These dates are generally April 15, June 16, September 15 of the current year, and January 15 of the following year unless you qualify for an exception based on specific conditions or income received.

- Use the "ESTIMATED TAX WORKSHEET" to calculate your estimated tax. Enter your federal taxable income and make the necessary adjustments to determine your South Carolina taxable income. Then, calculate the tax based on the provided Tax Computation Schedule.

- Subtract any credits from your calculated tax to determine your net tax liability. Include any additional taxes and subtract any state income tax already withheld or estimated to be withheld.

- If after these calculations your balance estimated tax is $1,000 or more, divide this amount by the number of payment periods remaining in the year to find out how much you need to pay for each quarter.

- Fill in the payment voucher for the corresponding due date. If you don't have a preprinted payment-voucher, write your correct name, address, and Social Security number clearly on the voucher. Enter the amount of payment as calculated on line 11 of the worksheet.

- Attach your check or money order made payable to the South Carolina Department of Revenue to the payment-voucher. Ensure your Social Security Number is written on your payment for identification.

- Mail the completed payment-voucher and your check or money order to the South Carolina Department of Revenue, Estimated Tax, at the provided address.

- Finally, fill in the "RECORD OF ESTIMATED TAX PAYMENTS" section to keep track of all payments made. This will be useful for your records and necessary when completing your income tax return.

By following these steps, you will have successfully completed and submitted your South Carolina 1040ES form. Staying organized and keeping records of your estimated tax payments will simplify your tax filing process come tax season.

Understanding South Carolina 1040Es

Who must file a South Carolina 1040ES form?

Every individual must file a South Carolina 1040ES form if they anticipate owing $1,000 or more in taxes for the year 2003. This includes residents, nonresidents, and part-year residents who earn South Carolina taxable income. There are exceptions, including individuals whose income is predominantly from farming or fishing, residents with no South Carolina tax liability in the previous year, and nonresident contractors earning over $10,000 with taxes withheld at source.

When are the due dates for filing the South Carolina 1040ES?

The estimated tax payments are due in four installments: April 15, June 16, September 15 of the current year, and January 15 of the following year. If an individual realizes the need to make estimated payments after the first due date, subsequent installments are adjusted accordingly.

What are the payment options for the South Carolina 1040ES?

Estimated taxes can be paid in equal amounts by the specified due dates using the provided vouchers. Taxpayers may also choose to pay all their estimated tax by April 15 or, instead of making the last payment on January 15, file a completed income tax return by January 31 and pay the full balance due.

Can a joint declaration of estimated tax be made?

Yes, a husband and wife living together can file a joint declaration of estimated tax. However, separate declarations are required in cases where couples have different taxable years or wish to use different last names for their filing.

What should I do if I need to amend my declared amount?

If you discover that your estimated tax changes significantly, you should file an amended declaration by the next due date using the standard declaration voucher for that period. Adjustments can be due to changes in income, exemptions, or tax withholding.

Is there a penalty for not filing or underpaying the estimated tax?

A penalty may be imposed for underpayment or late payment of estimated tax unless each installment is timely and at least 90% of the total tax due is paid. The penalty may be avoided by paying at least the total tax shown on the previous year's return, subject to certain conditions and income thresholds.

Common mistakes

Filling out tax forms can be a complex task, especially with the intricacies of state-specific forms like the South Carolina 1040ES. Individuals often encounter common pitfalls that lead to errors in their estimated tax declarations. Recognizing and avoiding these mistakes can streamline the tax filing process and ensure compliance with state tax regulations.

-

Incorrectly Calculating Estimated Tax: An essential step in completing the SC1040ES form involves accurately calculating the estimated tax owed. This calculation can be complex, integrating various factors such as expected annual income, applicable deductions, and credits. A frequent error is underestimating or overestimating these figures, leading to incorrect payment amounts. It's vital to use the tax computation schedule provided in the instructions and consider all sources of income and eligible deductions to make accurate estimations.

-

Failure to Update Personal Information: A common mistake on the SC1040ES is not updating personal information such as name, address, or Social Security number. This oversight can result in misdirected correspondence or errors in tax records. Individuals should check the preprinted payment-voucher for accuracy and make necessary corrections by clearly typing or printing changes.

-

Misunderstanding Payment Deadlines and Requirements: The SC1040ES form requires estimated taxes to be paid quarterly. Misunderstanding the due dates—April 15, June 16, September 15, and January 15—or the exceptions to these dates can lead to missed or late payments. For instance, taxpayers who realize a need to make estimated payments after April might not understand that their first payment deadline could be later, resulting in unnecessary penalties or overpayment.

-

Overlooking the Option to Amend Declarations: Financial situations can change, affecting estimated tax obligations. Taxpayers might not realize that the SC1040ES form allows for the amendment of estimated tax declarations if there is a significant change in income, exemptions, or withholdings. Failure to amend declarations when necessary can lead to discrepancies and potential penalties. Utilizing the amended declaration schedule timely ensures tax obligations accurately reflect current financial situations.

Avoiding these mistakes requires careful attention to detail, a thorough understanding of tax obligations, and a proactive approach to managing financial changes throughout the year. By addressing these common errors, taxpayers can streamline the filing process, ensure accuracy, and avoid potential penalties associated with the SC1040ES form.

Documents used along the form

When managing taxes, especially with forms like the South Carolina 1040ES for estimated taxes, individuals often find themselves needing additional documents and forms to accurately complete their tax responsibilities. Understanding these documents can make the tax filing process smoother and help avoid any potential issues.

- SC W-4: The South Carolina Employee's Withholding Certificate is where employees indicate their tax withholding preferences. Depending on changes in one’s personal or financial situation, adjusting withholdings may be necessary to avoid underpayment or overpayment of taxes.

- SC1040: The South Carolina Individual Income Tax Return is the form used by residents to file their annual income tax. It is where all information from the year, including estimated taxes paid, is reconciled.

- SC2210: The Underpayment of Estimated Tax by Individuals form calculates any potential penalties for underpayment of estimated taxes throughout the tax year. This form is essential for those who didn’t meet the required payment threshold through withholding or estimated tax payments.

- SC4868: Application for Automatic Extension of Time to File is for taxpayers who need additional time to file their SC1040. Filing this form provides an extension, though it does not extend the time to pay any taxes due.

- SC1040TC: The Tax Credits form is necessary for individuals claiming various tax credits offered by South Carolina, which can reduce the amount of tax owed. Understanding available tax credits is essential for maximizing one's refund or minimizing the amount owed.

- SC Schedule NR: The Nonresident Schedule is for individuals who earned income in South Carolina but are not residents. It helps calculate the tax owed based on the amount of income earned within the state.

Each of these forms plays a significant role in the tax filing process for individuals in South Carolina. Correctly utilizing these documents can ensure accurate tax payments, claim permissible credits, and ultimately contribute to a smoother tax filing experience. Taxpayers should ensure they are familiar with each relevant document to fully comply with state tax laws and optimize their financial outcomes.

Similar forms

The federal Form 1040-ES, "Estimated Tax for Individuals," shares a fundamental resemblance to the South Carolina 1040ES form, as both serve the purpose of calculating and paying estimated taxes on income not subject to withholding. This similarity extends to the requirement that individuals who expect to owe a certain threshold of tax ($1,000 for both federal and state levels) must make quarterly tax payments. These documents guide taxpayers through estimating their income for the year, factoring in deductions, credits, and previously paid taxes to determine the amount of estimated tax owed.

The Form W-4, "Employee's Withholding Certificate," bears a conceptual relation to the SC 1040ES in that it influences an individual's tax liability management. While the W-4 helps employees determine the amount of tax to be withheld from their paychecks to avoid underpayment or overpayment of taxes, the 1040ES is employed by individuals to estimate and pay taxes directly to the tax authorities quarterly. Both forms are tools for taxpayers to align their tax payments with their projected tax liability, albeit in different contexts.

State-issued estimated tax forms for other U.S. states, such as the California Form 540-ES, similarly parallel the South Carolina 1040ES form in structure and function. These forms provide a mechanism for residents to calculate and remit their state tax on income not subject to regular withholding, such as earnings from self-employment, business profits, and other sources. Despite variations in rates and specific tax laws, the underlying purpose remains consistent across states, emphasizing the universality of estimated tax payments within the U.S. tax system.

The 1099-MISC, "Miscellaneous Income," form is indirectly connected to the SC 1040ES through the type of income it reports. Individuals receiving income reported on Form 1099-MISC, such as freelancers and independent contractors, often use the 1040ES form for both federal and state levels to calculate and pay estimated taxes on that income. The reporting of non-employee compensation necessitates the consideration of estimated tax payments due to the lack of tax withholding on such earnings.

The Schedule C, "Profit or Loss from Business," form, used by sole proprietors to report business income and expenses to the IRS, is complementary to the SC 1040ES. Taxpayers who file Schedule C typically must use the 1040ES form to calculate their estimated tax payments for income derived from their business operations. The necessity for estimated tax payments arises from the self-employment status, which lacks automatic tax withholding mechanisms inherent in traditional employment situations.

Form SC2210, "Underpayment of Estimated Tax by Individuals," shares a direct correlation with the SC 1040ES by addressing the consequences of failing to accurately prepay taxes through estimated tax payments. Taxpayers who do not meet the required payment thresholds outlined in the 1040ES instructions may need to file Form SC2210 to calculate any underpayment penalty. This interaction underscores the importance of accurate estimated tax computation and timely payment to avoid additional charges.

The U.S. Office of Personnel Management (OPM) form for changing federal tax withholding for civil service retirees interacts with the SC 1040ES by offering an alternative withholding option to manage state tax liability. While the 1040ES facilitates direct quarterly payments to the South Carolina Department of Revenue, civil service retirees can adjust their federal withholding to cover expected state tax obligations, potentially reducing the need for estimated tax payments.

The Form W-9, "Request for Taxpayer Identification Number and Certification," while primarily used for information reporting on income earned from interest, dividends, and freelance work, indirectly relates to the SC 1040ES. Self-employed individuals and contractors who provide their Taxpayer Identification Number (TIN) through W-9 forms to entities from which they receive income, subsequently use the SC 1040ES to calculate and pay estimated taxes on that income. This link underscores the broader tax compliance framework within which these forms operate.

The Schedule NR, "Nonresident Tax Calculation for Form 1040 State Filers," for states that tax nonresident income, is analogous to parts of the SC 1040ES process. Nonresidents earning income in a state where they do not reside must often make estimated tax payments similarly to residents. Though specifics vary by state, the necessity for nonresidents to comply with local tax laws through estimated payments or other mechanisms parallels the SC 1040ES structure, emphasizing the wide-ranging applicability of estimated tax considerations.

Lastly, the Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," while serving a different immediate purpose—requesting additional time to file an annual tax return—connects to the SC 1040ES through its considerations for taxpayers who estimate they owe tax. Taxpayers filing Form 4868 are often advised to pay their estimated tax liability to avoid penalties and interest, a process that draws upon similar calculations and considerations as filling out the 1040ES, highlighting the interconnectedness of tax planning and payments.

Dos and Don'ts

Filling out the South Carolina 1040ES form is an important step in managing your taxes. Here are some dos and don’ts to help guide you through the process:

Do:- Verify your personal information: Ensure your name, address, and Social Security number are correct. If using a preprinted voucher and details are incorrect, make necessary corrections.

- Use the worksheet: The provided worksheet is a valuable tool for accurately computing your estimated tax. Utilize it to avoid errors.

- Pay attention to deadlines: File the declaration of estimated tax vouchers by the specified due dates to avoid penalties.

- Report all relevant incomes: Include all sources of income to determine your estimated tax accurately.

- Consider state adjustments: Remember to apply allowable state adjustments to your federal taxable income for an accurate state tax estimate.

- Check the tax computation schedule: Use the correct tax computation schedule to ensure the tax you calculate matches your income bracket.

- Keep records: Maintain a record of all estimated tax payments made for your reference and future tax filings.

- Correct errors promptly: If you realize your estimated tax needs amending, do so before the next due date using the regular voucher.

- Explore withholding options: If applicable, consider modifying your withholdings with your employer or other income sources to cover the estimated tax due.

- Contact the department for discrepancies: If you encounter issues or notices due to estimated payment credits, communicate with the South Carolina Department of Revenue for clarification.

- Ignore the payment schedule: Failing to follow the installment payment dates can lead to penalties.

- Estimate inaccurately on purpose: Intentionally underestimating your tax can result in penalties and interest on the unpaid amount.

- Overlook deductions and credits: Missing out on allowable deductions and credits can lead to overestimation of taxes due.

- Delay amendments: If your financial situation changes significantly, don't delay amending your estimated tax accordingly.

- Forget to check for updates: Tax laws and rates can change. Always use the most current forms and instructions.

- Submit incomplete forms: Ensure all required sections of the form are completed to avoid processing delays.

- Miss recording payments: Failure to keep track of your payments could lead to confusion about what you owe or have overpaid.

- Ignore nonresident instructions: Nonresidents should follow specific instructions provided to accurately determine and report their estimated tax.

- Overlook joint filing nuances: If filing jointly, understand how it affects your estimated tax, especially if you and your spouse have different income types or levels.

- Disregard the opportunity to apply overpayments: If you’ve overpaid in previous years, consider applying these amounts to your current estimated tax.

Misconceptions

When it comes to the South Carolina 1040ES form, there are several widespread misconceptions that can confuse taxpayers. Understanding these nuances can lead to a smoother tax filing experience.

- Misconception 1: The SC1040ES is only for self-employed individuals. While it's true that self-employed taxpayers often need to pay estimated taxes, this requirement isn't exclusive to them. Individuals who expect to owe $1,000 or more when filing their return—due to various sources of income such as dividends, interest, rent, or even gains from the sale of assets—must file this form.

- Misconception 2: If you file the SC1040ES, you don't have to file an annual income tax return. Filing the SC1040ES is merely a means to pay estimated tax on income that isn't subject to withholding. It doesn't absolve taxpayers of the responsibility to file an annual income tax return. The estimated tax payments made with the SC1040ES will be credited against the total tax liability calculated when the annual return is filed.

- Misconception 3: Payments are optional if you anticipate a refund. Even if you expect a refund, you may still need to make estimated tax payments. This situation can arise if, throughout the year, you have periods of income not covered by withholding or not subject to sufficient withholding. The key is ensuring that enough tax is paid throughout the year (through withholding or estimated payments) to avoid penalties.

- Misconception 4: All taxpayers must follow the same payment schedule. While the standard payment due dates for estimated taxes are April 15, June 15, September 15 of the current year, and January 15 of the following year, there are exceptions. Taxpayers who come to meet the filing requirements within different periods of the taxable year have specific due dates that might not align with the standard schedule.

Understanding these misconceptions ensures that taxpayers can navigate the complexities of the SC1040ES form effectively, avoiding common pitfalls and ensuring compliance with state tax obligations.

Key takeaways

Filling out the South Carolina 1040ES form is crucial for individuals who expect to owe $1000 or more in taxes when they file their income tax return. Here is a simplified guide to help you understand and complete the form effectively:

- Know the filing deadlines: Generally, the 1040ES form is due on April 15, June 16, September 15, and January 15. However, if you start or adjust your income during certain periods of the year, other deadlines might apply.

- Who needs to file: If you live in South Carolina, are a nonresident with South Carolina income, or are a part-year resident and expect to owe $1000 or more in taxes, you need to file this form. Special rules may apply to farmers, fishermen, and certain nonresidents.

- Consider adjusting your withholdings: You might be able to avoid filing the 1040ES by having more tax withheld from your wages. This can be done by updating your withholding exemption certificate through your employer.

- Payment schedule: You can choose to pay all your estimated tax by April 15 or in quarterly installments. If you file your income tax return by January 31 and pay the full balance of your taxes, you do not need to make the last estimated tax payment.

- Single vs. joint declarations: Couples who are married and living together can file jointly, but there are exceptions. If you and your spouse have different taxable years or wish to use different last names, separate filings are required.

- Amending your declaration: If there’s a significant change in your income, exemptions, or withholdings, you'll need to amend your estimated tax. This can be done using the regular declaration voucher for the pertinent filing period.

- Penalties for underpayment: If you do not pay enough estimated tax or miss a payment, you might face a penalty unless 90% of your tax liability is paid through withholdings or quarterly estimates. There are ways to avoid this penalty, like paying 100% of the prior year's tax (110% if your income is over $150,000).

- Completing the payment voucher: Make sure the preprinted information on your payment voucher is correct. If not, correct it. Enter the amount of your payment, attach your check or money order, and mail it to the appropriate address. Maintain a record of all payments made, as the Department will not send you a statement.

Understanding these key points will help simplify the process of filing your South Carolina 1040ES form. Always double-check your dates and figures to ensure you comply with state tax requirements.

More PDF Templates

Dhec 4024 Form Printable - It's essential for applicants to check the correct level of EMS certification they are applying for on the form.

At What Age Do You Stop Paying Property Taxes in South Carolina? - Supportive housing projects backed by HUD and serving special populations, adhering to categorized criteria, can seek property tax exemptions.

Irs Form 3911 Instructions - This document assists taxpayers in tracing their state refund checks through the Department of Revenue.