Fill Your State Of South Carolina St455 Template

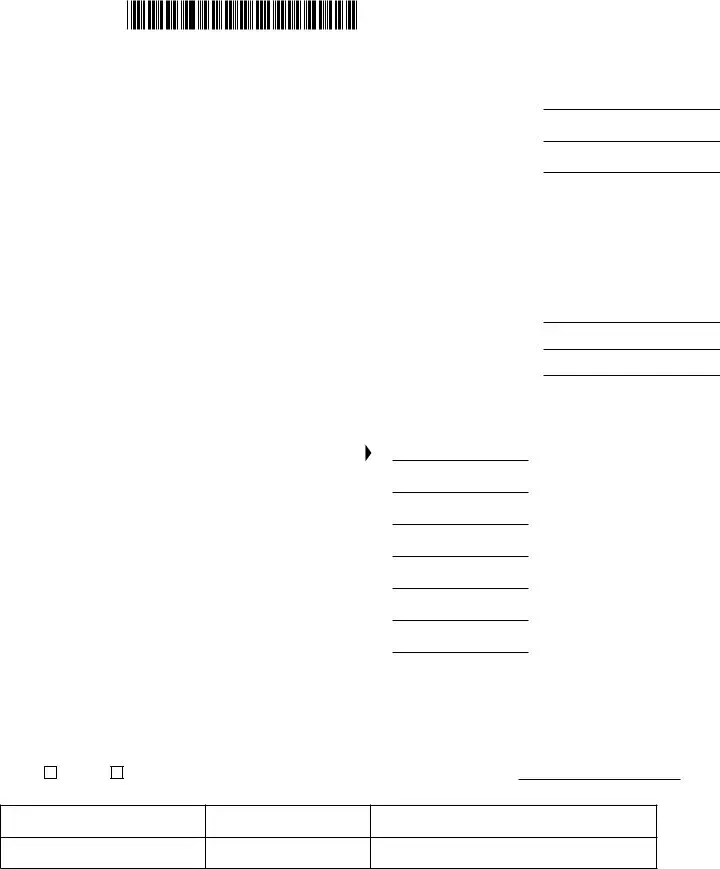

Understanding the State of South Carolina ST-455 form is crucial for businesses operating within its borders. This comprehensive form, designed by the Department of Revenue and last revised on July 18, 2019, serves multiple purposes, including filing state sales, use, and maximum tax returns. Businesses are required to indicate their status through various selections, such as noting changes in address, closing, or amending previous submissions. The form intricately requires the disclosure of gross proceeds from sales or rentals, total deductions, and net taxable sales, which are then used to calculate the due taxes at both 6% and 5% rates, depending on the nature of the goods or services provided. Local taxes, penalties, and interests are also calculated, ensuring businesses comply fully with South Carolina's tax regulations. With sections dedicated to both general and specific tax situations, including exemptions and deductions like those for sales during the "Sales Tax Holiday" or for transactions on the Catawba Reservation, accuracy and attention to detail are paramount in completing the ST-455 form. This document is not just a tax return; it's a declaration of a business's financial interactions within the state, necessitating a timely and precise submission to avoid penalties. Moreover, the form's design to facilitate discussions between the tax preparer and the Department of Revenue officials, along with clear instructions for mailing based on the balance due, indicates a structured approach to tax filing in South Carolina.

Document Example

1350

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

|

|

|

(Rev. 7/18/19) |

||

|

|

|

|

|

STATE SALES, USE, AND MAXIMUM TAX RETURN |

|

||||||||||

|

|

dor.sc.gov |

|

|

5162 |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Place an X in all boxes that apply. |

|

|

|

|

|

|

RETAIL LICENSE OR USE TAX REGISTRATION |

|

||||||||

|

AMENDED |

Change of Address |

Business Permanently Closed |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||||||

|

(Make changes to |

Date |

|

|

|

|

|

|

|

|

|

|||||

|

Return |

|

|

|

|

|

|

|

|

|

||||||

|

address below) |

|

(Complete form |

|

|

|

|

|

|

|||||||

|

|

|

|

FEIN |

|

|||||||||||

|

|

|

|

|

|

|

||||||||||

|

If the area below is blank, fill in name and address. |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

SID Number |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Period Ended |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPLETE THE WORKSHEET ON THE REVERSE SIDE FIRST. |

File online at MyDORWAY.dor.sc.gov |

||||||||||||

1. |

All gross proceeds of sales/rental, |

|

|

. |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Use Tax and withdrawals for own use |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Column A |

|

|

|

|

Column B |

|||||||

|

|

(from worksheet Item 3) |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Sales/Use 6% (Tax Rate) |

|

|

|

|

Sales/Use 5% (Tax Rate) |

||||||

1A. |

Total gross proceeds of sales/rental, |

|

|

. |

|

|

|

|

. |

|

|

|||||

|

|

Use Tax and withdrawals for own use |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(from worksheet Item 6 and Item 12) |

|

|

|

|

|

|

|

|

|

|

|

|||

2. |

Total amount of deductions |

|

|

|

. |

|

|

|

|

. |

|

|

||||

|

|

(from worksheet Item 8 and Item 14) |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3. |

Net taxable sales and purchases |

|

|

|

. |

|

|

|

|

. |

|

|

||||

|

|

(subtract line 2 from line 1A for each column) |

|

|

|

|

|

|

|

|

|

|

|

|||

4. |

Tax due: line 3 multiplied by tax rate |

|

6% |

. |

|

5% |

. |

|

|

|||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Sales

Sales and Use Tax due

5.(add line 4 of Columns A and B) Local taxes due

6.

7.(add lines 5 and 6)

Taxpayer's discount (See instructions. For

8.timely filed returns and taxes paid in full only.)

Net tax payable

9.(subtract line 8 from line 7)

|

|

10A |

Penalty (see instructions) |

|

|

10B |

Interest (see instructions) |

10 |

Total penalty and interest |

||

(add lines 10A and 10B) |

|||

11. |

Total amount due |

||

(add lines 9 and 10) |

|||

5.

6.

7.

8.

9.

10A.

10B.

10.

11.

.

.

.

.

.

.

.

.

.

IMPORTANT: Sign and date return on reverse side. Attach form

Mail to:

Balance Due: SCDOR, PO Box 100193, Columbia, SC 29202

Zero Due: SCDOR, PO Box 125, Columbia, SC

51621068

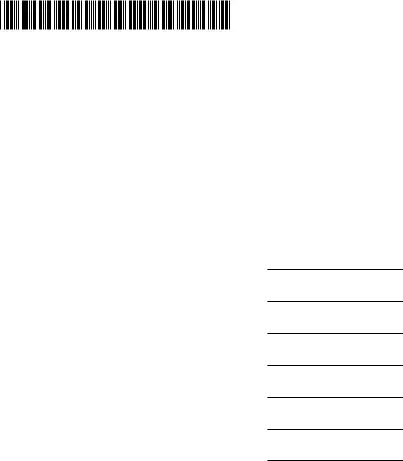

Sales and Use Tax - Worksheet #1

Item 1.

Item 2.

Item 3.

Gross proceeds of sales/rentals and withdrawals for own use |

1. |

2. |

|

Total - Gross proceeds of sales/rental, Use Tax, and withdrawals for own use |

3. |

(Add Items 1 and 2. Enter total here and on Iine 1, Column A, on front of |

|

If local tax is applicable, enter the total on ltem 1 of

Note: Sales of unprepared foods are exempt from the state Sales and Use tax rate. However, local taxes still apply to sales of unprepared foods unless the local tax law specifically exempts such sales. Sales that are subject to a local tax must be entered on the

6% Sales and Use Tax - Worksheet #2

Item 4.

Item 5. Item 6.

Item 7.

Gross proceeds of sales/rentals and withdrawals of inventory for own use |

4. |

|

(Enter sales subject to 6% tax rate requirements.) |

||

|

||

5. |

||

Total gross proceeds at 6% (Add Items 4 and 5. Enter total here and on line 1A, |

|

Column A on front of |

6. |

|

Sales and Use tax allowable deductions (Itemize by type of deduction and amount of deduction)

Type of deduction |

Amount of deduction |

a. Sales Exempt During "Sales Tax Holiday" in August |

$ |

b. Sales over $100 delivered onto Catawba Reservation |

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

Item 8. Total amount of deductions (Enter total here and on line 2 of Column A on front of |

8. |

|

< |

> |

|

Item 9. Net taxable sales and purchases (Subtract Item 8 from Item 6. Enter total here and on |

|

|

|

|

|

line 3, Column A on front of |

9. |

|

|

|

|

|

|

|

REMINDER: Form

I authorize the Director of the SCDOR or delegate to discuss this return, attachments, and related tax matters with the preparer.

Yes

No

Preparer's name |

|

Phone number |

I hereby certify that I have examined this return and to the best of my knowledge and belief it is true and accurate.

Owner, partner, or other title |

Printed name |

Taxpayer's signature |

Daytime phone number |

Date |

IMPORTANT: Your return is DELINQUENT if it is postmarked after the 20th day of the month following the close of the period. Sign and date the return.

Questions? Call

51622066

5% Sales and Use Tax - Worksheet #3

Item 10. |

Gross proceeds of sales/rentals and withdrawals for own use |

10. |

|

Item 11. |

(Enter sales subject to 5% tax rate requirements such as airplanes and boats.) |

|

|

11. |

|

||

Item 12. |

Total gross proceeds at 5% (Add Items 10 and 11. Enter total here and on line 1A, |

|

|

|

Column B on front of |

12. |

|

Item 13. |

Sales and Use Tax allowable deductions (Itemize by type of deduction and amount of deduction) |

||

|

Type of deduction |

Amount of deduction |

|

a. Sales over $100 delivered onto Catawba Reservation |

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

Item 14. Total amount of deductions (Enter total here and on line 2 of Column B on front of

Item 15. Net taxable sales and purchases (Subtract Item 14 from Item 12. Enter total here and on line 3, Column B on front of

14. |

< |

> |

|

|

15. |

|

|

|

|

51623064

Form Properties

| Fact | Detail |

|---|---|

| Form Type | State Sales, Use, and Maximum Tax Return |

| State | South Carolina |

| Governing Law | South Carolina Department of Revenue regulations |

| Online Submission | Available through MyDORWAY.dor.sc.gov |

Guide to Writing State Of South Carolina St455

After you have completed transactions relevant for the State of South Carolina ST-455 form, such as sales, rentals, or use tax transactions within the state, you'll need to accurately report these details to the South Carolina Department of Revenue. This form aids in calculating and reporting state sales, use, and maximum tax dues. Following the given instructions will ensure your submission is correct and compliant with state tax regulations.

- First, check any boxes that apply at the top of the form, including if it's an amended return, you've changed your address, or if your business has permanently closed. Be sure to complete form C-278 if you’re closing your business.

- Fill in your FEIN (Federal Employer Identification Number), SID Number, and Period Ended (MM-YY).

- Complete the worksheet on the reverse side of the ST-455 form before entering information on the front. This worksheet will help calculate totals needed for the ST-455.

- Enter all gross proceeds of sales, rentals, use tax, and withdrawals for own use in Columns A and B as instructed. Columns A and B differentiate between the 6% and 5% tax rates, respectively.

- Record the total amount of deductions from the worksheet (Items 8 and 14), then calculate your net taxable sales and purchases by subtracting these deductions.

- Calculate the tax due by multiplying the net taxable sales and purchases by the respective tax rate for each column (6% for Column A, 5% for Column B).

- Add together the total sales and use tax due from Columns A and B, and fill in any local taxes due on line 6.

- Calculate the total sales and local taxes owed by adding the amounts from lines 5 and 6.

- Compute your taxpayer's discount for timely filed returns and taxes paid in full (as detailed in the form instructions), and subtract this from your total sales and local taxes to find the net tax payable.

- Fill in any penalties or interest owed in lines 10A and 10B, then calculate the total penalty and interest.

- Add together the net tax payable and total penalty and interest to determine the total amount due, and enter this on line 11.

- Confirm your authorization on the reverse side for a delegate to discuss the return, add the preparer’s name and phone number if relevant.

- Sign and date the form, providing your title, printed name, email, and daytime phone number for any further questions.

- If applicable, attach form ST-593 and mail your completed form to the appropriate address provided on the form, depending on whether a balance is due or zero due.

Ensure all information provided is accurate and complete to avoid any delays or questions from the Department of Revenue. Prompt submission before the postmarked deadline will help avoid any late penalties.

Understanding State Of South Carolina St455

What is the ST-455 form used for in South Carolina?

The ST-455 form is a tax return document used by the State of South Carolina for reporting sales, use, and maximum taxes. Businesses need to complete this form to calculate and report the total sales tax owed to the state, including any use tax on out-of-state purchases, as well as any local taxes due.

How can I file the ST-455 form?

Businesses can file the ST-455 form online through the MyDORWAY portal at dor.sc.gov. This platform allows for a more straightforward submission process. Alternatively, if filing by mail, completed forms should be sent to the designated SCDOR PO Box addresses, depending on whether there is a balance due or not.

Can I amend a previously filed ST-455 form?

Yes, if you need to make changes to a previously filed ST-455 form, you can mark the "AMENDED" box at the top of the form. Be sure to accurately reflect all necessary changes in the amended return, including any changes in gross sales, deductions, and the net tax payable.

What should I do if my business address has changed?

If your business address has changed, indicate this by marking the "Change of Address" box on the ST-455 form. You must also update your address details in the provided area on the form to ensure that all communications and documents from the Department of Revenue are sent to the correct location.

What happens if my business permanently closes?

If your business has permanently closed, it is important to indicate this by checking the "Business Permanently Closed" box on the ST-455 form. Additionally, you must complete form C-278 and return your license to the Department of Revenue. This informs the state that you will no longer be filing returns for that business.

How is the tax due calculated on the ST-455 form?

The tax due is calculated by first determining the net taxable sales and purchases, which is the total gross proceeds minus any allowed deductions. This net amount is then multiplied by the applicable tax rates (6% or 5% as specified) to calculate the tax due for each category. Add the results for the total sales and use tax due, along with any local taxes, to find the net tax payable.

What deductions are allowed on the ST-455 form?

Allowable deductions on the ST-455 form include sales exempt during the "Sales Tax Holiday" in August and sales over $100 delivered onto Catawba Reservation. Each deduction should be itemized by type and amount in the worksheet section before being totaled and reported on the main form.

What is the deadline for filing the ST-455 form?

The ST-455 form is considered delinquent if it is postmarked after the 20th day of the month following the close of the reporting period. To avoid penalties, ensure that your form is submitted timely either via mail or online through the MyDORWAY portal.

Common mistakes

When completing the State of South Carolina ST-455 form, individuals often encounter complexities that can lead to errors. Being aware of common mistakes can guide taxpayers to a correct and timely submission. The following outlines some of the prevalent errors observed:

-

Not placing an X in all applicable boxes at the beginning of the form. This section is critical for ensuring that the Department of Revenue understands the purpose of the submission, including whether it's an amended return, a change of address, or if the business has closed permanently.

-

Failing to accurately complete the gross proceeds section. This involves overlooking the inclusion of all sales, rentals, and withdrawals for own use in Column A and B (Items 1, 2, and 3 on the worksheet #1 and Items 10 and 11 on worksheet #3), which can significantly impact the total amount of tax due.

-

Incorrect deduction calculation. Taxpayers frequently miscalculate the total amount of deductions in the worksheets provided (Item 8 on worksheet #2 and Item 14 on worksheet #3), either by failing to itemize deductions properly or by misunderstanding what qualifies as an allowable deduction.

-

Omitting local taxes and special tax jurisdictions. The ST-389 form, which is necessary for reporting local taxes, is often neglected or incorrectly filled. This results in the incorrect calculation of total sales and local taxes due (Line 6 of the ST-455).

While these errors can present obstacles to accurate reporting, they are avoidable with careful attention to detail and a thorough understanding of the form’s requirements. Taxpayers are encouraged to consult the instructions provided by the Department of Revenue or to seek professional advice when uncertain. Doing so can ensure compliance and prevent the accrassment of penalties or interest due to inaccuracies or omissions.

Documents used along the form

When businesses in South Carolina fill out the State Sales, Use, and Maximum Tax Return form (ST-455), they often need to accompany this form with additional documents to ensure compliance with the state's Department of Revenue requirements. These additional documents help provide a clearer picture of the business's financial transactions and tax liabilities.

- ST-389: Known as the Local Tax Worksheet, form ST-389 is essential for businesses that conduct sales subject to local taxes in South Carolina. This form helps businesses calculate and report the local taxes due on their total sales. It is often required in conjunction with the ST-455 to accurately report both state and local sales and use taxes.

- C-278: This Change of Address/Business Closure form is necessary when a business changes its address or permanently closes. If a business indicates on the ST-455 that there has been a change of address or closure, form C-278 must be completed and submitted to ensure the Department of Revenue has the most current information.

- ST-593: The Sales Tax Exemption Certificate, form ST-593, must be attached to the ST-455 if applicable. This form is used by businesses to claim exemptions for certain types of sales or purchases that are exempt from sales and use tax under South Carolina law.

- Registration Documents: When filing the ST-455 for the first for the first time or after making changes to the business structure or ownership, updated registration documents may need to be filed with the Department of Revenue. These documents provide necessary details about the business, such as its legal structure, FEIN, and the products or services it offers, ensuring that the business is properly registered for tax purposes in South Carolina.

Together, these forms and documents ensure businesses comply fully with South Carolina's tax regulations. Proper completion and filing of these documents help avoid penalties and ensure that businesses pay the correct amount of taxes due. It is important for businesses to stay informed about the specific requirements and deadlines for each document to maintain good standing with the South Carolina Department of Revenue.

Similar forms

The Form ST-1, often used in other states for reporting sales and use tax, shares common ground with the South Carolina ST-455 form. Both forms are designed for businesses to report and remit taxes collected from sales, rentals, or services provided. They require detailed accounting of gross proceeds, tax-exempt sales, and taxable sales, followed by the calculation of tax due. Each form is unique to its state but serves the same foundational purpose of tax declaration for businesses.

Similar to the ST-455, Form Sales Tax Exemption Certificate (variously numbered by state) is another document essential for businesses. While the ST-455 is focused on reporting sales and use tax, exemption certificates are used by purchasers to notify sellers of their tax-exempt status. Both interact in the universe of sales tax by defining what gets taxed and what doesn't, based on the nature of the purchase and the purchaser's status. This interaction ensures the correct application and remittance of sales tax.

The Employer's Quarterly Federal Tax Return, Form 941, parallels the ST-455 in terms of periodic tax reporting. While Form 941 pertains to federal payroll taxes withheld from employees, including social security and Medicare taxes, the ST-455 deals with state-level sales and use taxes. Both forms are crucial for compliance with respective tax obligations and require accurate record-keeping and timely submission to avoid penalties.

The Annual Resale Certificate for Sales Tax, which varies by state, is akin to certain aspects of the ST-455. It allows businesses to purchase goods tax-free that will be resold. The nexus between them lies in the sale and purchase transactions taxable under state law. They ensure that tax is only applied to the end consumer, preventing double taxation throughout the supply chain.

Form W-2, Wage and Tax Statement, while primarily for reporting wages, tips, and other compensation paid to employees, shares the essential feature of tax reporting with the ST-455. Both are formal documents required by government entities to ensure tax compliance and proper collection and remittance of taxes. These forms play significant roles in the broader tax system, contributing to state and federal revenue.

Use Tax Registration forms, specific to each state, share similarities with the ST-455 in that they address the use tax aspect. While the ST-455 encompasses both sales and use tax reporting, a Use Tax Registration form is specifically for businesses to register for use tax obligations. This distinction highlights the two sides of consumer tax – for purchasing items for use or consumption when sales tax wasn't charged at the point of sale.

The Form 1040, U.S. Individual Income Tax Return, although catering to individuals, complements the ST-455's role in the tax infrastructure. Both facilitate the collection of taxes, albeit for different tax types – sales and use tax versus income tax. Each form is integral to the taxpayer's compliance with state and federal laws, ensuring accurate revenue collection for government operations.

Certificate of Registration forms, required for businesses to legally operate within a state, indirectly connect with the ST-455 form. Before a business can file taxes using forms like the ST-455, it must first be registered and recognized by the state. This registration is a prerequisite for tax filing and compliance, establishing the legal and operational framework within which sales and use taxes are collected and remitted.

The Business License Application, common across municipalities, while not a tax document per se, alignths with the essence of the ST-455. Both are foundational to a business's operation within a jurisdiction, ensuring compliance with local laws and tax obligations. The application for a business license is a step towards becoming a tax-remittant entity, further clarified and quantified through tax reporting forms like the ST-455.

The Vehicle Registration Tax and Fee forms, specific to each state's Department of Motor Vehicles (DMV), while primarily for vehicle registration, share the principle of state-level taxation and form submission with the ST-455. Each vehicle registration includes fees and taxes that contribute to state revenue, similar to sales and use taxes reported on the ST-455. These forms collectively embody the diverse nature of state tax collection mechanisms, serving various sectors and purposes.

Dos and Don'ts

When completing the State of South Carolina ST-455 form, there are essential do's and don'ts you should be aware of to ensure accuracy and compliance. Follow these guidelines to navigate the form successfully.

Do's:- Double-check all entries for accuracy before submission, ensuring that the figures entered on the front of the form match those calculated on the reverse side.

- Make sure to place an X in all boxes that apply to your specific situation, such as "AMENDED" if you are submitting an amended return, or "Business Permanently Closed" if applicable.

- Fill in all blank areas with your correct name, address, and relevant identification numbers, including the Retail License or Use Tax Registration, FEIN, and SID Number.

- Calculate all taxes due carefully, following the instructions for each line to ensure that you’re applying the correct tax rates and deducting allowable amounts correctly.

- Sign and date the return on the reverse side, verifying that the information provided is true and accurate to the best of your knowledge.

- Choose the correct mailing address based on whether you have a balance due or a zero due to ensure timely processing.

- Don't leave any required fields blank. Incomplete forms may result in processing delays or the return being sent back to you for correction.

- Don't forget to attach the required form ST-593 if applicable to your return. Failing to include necessary attachments can lead to processing issues.

- Don't disregard local taxes. If your sales or withdrawals for own use are subject to local taxes, complete and attach form ST-389 as required.

- Don't calculate your taxpayer's discount incorrectly. Make sure to read the instructions carefully if you qualify for a discount for timely filing and full payment.

- Don't miss the submission deadline. Returns are delinquent if postmarked after the 20th day of the month following the close of the period, which may result in penalties and interest.

- Don't estimate amounts. Use the exact figures from your records to complete the worksheets and form entries to avoid discrepancies and potential audits.

Misconceptions

When dealing with the State of South Carolina ST-455 form, it's crucial to navigate through common misconceptions to ensure accurate and lawful tax reporting. Here are seven misconceptions that need clarification:

- Use Tax is only for large businesses. Many believe that the Use Tax section of the ST-455 is applicable solely to large corporations. In reality, this tax applies to all businesses, including small and medium-sized, that purchase goods or services out-of-state for use, storage, or consumption in South Carolina when sales tax has not been collected by the seller.

- The form is only for reporting sales tax. A common misunderstanding is that the ST-455 form's sole purpose is to report sales tax. However, it also covers Use Tax and Maximum Tax, providing a comprehensive platform for businesses to report and pay various taxes owed to the state.

- Digital filing is an alternative, not a requirement. Some might think that filing online through MyDORWAY is just an option. The truth is, the Department of Revenue encourages, and in some cases may require, electronic filing because it is more efficient, faster, and reduces errors compared to paper filing.

- All sales are taxed at the same rate. It's a misconception that all sales and purchases reported on the ST-455 are taxed at a universal rate. South Carolina has different tax rates for sales/use tax (6% or 5%) and other specific items might be taxed differently or be exempt from tax, highlighting the need to accurately understand tax liabilities.

- Deductions are only for goods resold. Deductions on the ST-455 form are often mistakenly thought to be applicable only to goods that are purchased for resale. However, the form allows for various deductions, including but not limited to goods resold, items withdrawn for own use, and sales exempt during the "Sales Tax Holiday."

- Penalties are only for late payments. Another misconception is that penalties assessed with the ST-455 are strictly for late payments. While late payments do incur penalties, inaccuracies or omissions in the filing can also lead to penalties, making thorough and accurate reporting crucial.

- A change of address doesn't affect the ST-455. Some might assume that a change in business address is inconsequential to the ST-455 filing. This is incorrect; notifying the Department of Revenue of address changes is important to ensure that all correspondence and legal documents are correctly directed, thereby avoiding unnecessary complications with tax filings.

Clearing up these misconceptions ensures that businesses can accurately fulfill their tax obligations, avoid penalties, and maintain good standing with the South Carolina Department of Revenue.

Key takeaways

Filling out the State of South Carolina ST-455 form correctly is essential for businesses to ensure they comply with tax regulations. Here are seven key takeaways to help guide you through the process:

- Online Filing Option: You can file the ST-455 form online via MyDORWAY.dor.sc.gov, offering a convenient and faster submission process.

- Updating Information: It's crucial to indicate any changes by marking the appropriate boxes at the top for amendments, change of address, or if the business has permanently closed.

- Worksheets: Completing the worksheets on the reverse side first aids in accurately calculating sales, use, and maximum tax due, guiding you through items that need to be reported on the front.

- Itemizing Sales and Deductions: Clearly itemizing gross proceeds of sales/rentals, withdrawals for own use, and deductions—articulated in the worksheets—is necessary for both 6% and 5% tax rates, helping determine net taxable sales and purchases.

- Local Taxes: If local taxes apply to your sales, you must complete and attach form ST-389. This form captures details related to local sales and use taxes, which vary by location.

- Timely Filing Benefits: For returns filed by the deadline and taxes paid in full, a taxpayer’s discount is available, which can reduce the total amount of taxes payable.

- Penalties and Interests: Late submissions can lead to penalties and interest charges. Understanding how to calculate these fees (as instructed on the form) can prevent surprises when determining the total amount due.

- Submission Addresses Vary: The address to which you mail your form depends on whether you have a balance due or a zero tax due, so ensure to send it to the correct address to avoid processing delays.

Approaching the form with these key points in mind can streamline the process, ensure accuracy, and help maintain compliance with South Carolina's sales and use tax requirements.

More PDF Templates

What Is Form 8453 - Describes conditions under which state employees can opt out, including rehire situations with a break in service.

North Carolina Immunization Registry - A necessary step for school and daycare administrators in confirming that incoming children meet state health requirements.